Forum for discussion and essays on a wide range of subjects including technology, politics, economics, philosophy, and partying.

Search This Blog

Saturday, October 29, 2005

The Halloween Witch

The deal is this. If you leave your candy out when you go to sleep on Halloween night, the Halloween witch leaves you a nice gift in exchange for that candy. The more candy you leave out, the nicer the gift.

Our daughters typically keep one or two pieces of candy for themselves and let the Halloween witch have the rest. They get a nice gift (clothes or toys or something), nice teeth, and no upset stomachs. The Halloween witch gets the candy (which seems to make its way into a trash can since it's generally of marginal quality anyway). Parents get peace of mind. Everybody's happy!

It's amazing that our society is so rich that we have to come up with ways to throw our children's stuff away.

Friday, October 28, 2005

And Don't Forget the Shrinking Deficit

The US budget deficit shrank to $319 billion last year as better economic conditions boosted tax revenues. [...]2.6% of GDP also happens to be the average deficit since Reagan took office and I think deficits at that level are no problem - in fact that may be an optimal level (though I've recently revised my estimate of the optimal level down to between one and two percent of GDP). Recovery from the hurricanes may boost the 2006 deficit but it will also likely boost growth (deficits stimulate the economy). Then, assuming Bush doesn't get us into any more wars, the troops should start coming home from Iraq, and the deficit could drop quickly in 2007 and beyond. I think it's even possible that we'll go into the 2008 campaign season with a nearly balanced budget.

The 2005 fiscal year deficit amounted to 2.6% of GDP, below the 3.6% recorded in 2004 and the post World War Two high of 6% in 1983.

Category: cat_useconomy

New Fed Chairman

Consider for example a tax cut for households and businesses that is explicitly coupled with incremental BOJ [Bank of Japan] purchases of government debt ... Isn't it irresponsible to recommend a tax cut, given the poor state of Japanese public finances? To the contrary... nothing would help reduce Japan's fiscal woes more than healthy growth in nominal GDP.He is also one of the few Fed Governor's to regularly muse about the dangers of deflation, which I think could be an issue some time late this decade or next.

On the other hand, according to Don Luskin, Paul Krugman (a significantly left of center economist) likes him, so I figure Bernanke should be popular with just about everybody.

Category: cat_useconomy

Unstoppable?

The U.S. economy shook off headwinds from hurricanes Katrina and Rita to grow at a faster-than-expected 3.8 percent annual rate in the third quarter, a Commerce Department report showed Friday. [...]The economy accelerated, but core inflation slowed:

Wall Street economists had forecast GDP would advance at a 3.6 percent rate in the July-to-September quarter. The economy has now expanded at rates exceeding 3 percent for 10 straight quarters. [...]

Despite surging prices at the gasoline pumps, the report showed that so-called core inflation, which exempts food and energy from its calculation, declined in the third quarter. A price gauge favored by Federal Reserve Chairman Alan Greenspan -- personal consumption expenditures excluding food and energy -- increased at a 1.3 percent annual rate compared with 1.7 percent in the second quarter. That marks the mildest rate of core price rises since the second quarter of 2003.Inventories were reduced, opening the way for further expansion to replace those inventories:

Businesses reduced inventories for a second straight quarter. Stocks of unsold goods dropped at a $16.6-billion annual rate in the third quarter after declining at a $1.7-billion rate in the second quarter.

The third-quarter inventory drop was the largest since the fourth quarter of 2001 -- after the attacks in New York and on the Pentagon -- when they fell at an $86.7-billion rate, a department official said. It also marked the first back-to-back quarterly drops in stocks of unsold goods since the third and fourth quarters of 2001.

Good news all around. Hurricanes, floods, wars, government incompetence - and the U.S. economy keeps on truckin'. Amazing.

Category: cat_USeconomy

Thursday, October 27, 2005

Understanding the Other Side

Though I'm personally agnostic when it comes to religion, I'm definitely not anti-religious and have come to respect the worldview of the religious. The purpose of this post is to begin characterizing my interpretation of that worldview in order to identify the basis of the asymmetry of understanding mentioned above.

Let's say you believe in a deity that has created the universe, the earth, life, and so forth. It would follow that this deity is pretty powerful. Indeed, so powerful as to have been able to create and recreate whatever historical evidence has been observed.

While it's inherently circular logic, if one believes in such a deity, the most rational explanation for the state of the world and its historical context is that the deity created it that way. Why did this Creator do things like create fossils that seem to be hundreds of millions of years old and erase any sign of the Flood? Who knows, He has His reasons, perhaps He was testing our faith. Whatever. Keep in mind that circular logic is always inherently self-consistent. Just like tautologies are always true. Therefore, if you believe in a Creator style deity, it's perfectly rational to conclude that the Creator created the universe, the Earth, and life.

"But", you say, not believing in this Creator, "there's no evidence that He exists or did any of this creating." Well, that depends on what one counts as evidence, but it's immaterial (so to speak). The belief in this Creator cannot be proven to be False. And your assumptions about Deep Reality, whatever they are, cannot be proven to be True. In other words, you don't really know how this observable reality came to be, what causes it to continue to be, and when it started either.

"But", you say, "I consider only observable reality, not Deep Reality or supernatural forces, and thus my worldview is more rational and valid." Rationality is sometimes a good thing, but rationality that builds on flawed assumption can be downright evil. Marx was perfectly rational, for example, but the logical outcome of his thinking caused an awful lot of misery and death. But more importantly, everybody has no choice but to consider things beyond observable reality. Everything has a historical context, without which, it has no meaning. Nobody alive directly observed anything before 150 years ago and nobody ever observed and recorded anything that was prehistoric. You believe in Evolution and Common Descent? Fine, but that belief requires faith that the past, which wasn't observed by anyone, has been correctly deduced by the high priests of archeology.

"But", you say, "that's the only explanation for the plethora of lifeforms that exist." Well, no, it's not. Creationism and Intelligent Design are two immediate examples that come to mind. They may well be wrong, but they are still explanations. I also like the "Matrix" example, where we're all part of some computer simulation, version 5.2, which was just rebooted yesterday (in our time). In fact, there are an infinite number of non-proveable and non-disproveable explanations for why the world and life exist. Because they can be neither proven (with certainty) nor disproven, they require faith, just like you have faith in Evolution and Common Descent.

"But", you say, "Common Descent via Evolution is the only explanation for the plethora of lifeforms that doesn't rely on supernatural explanations." Certainly not true again. If we sat down and spent a lot of time and effort, we could come up with an alternate, but likely substantially more complicated theory that explains the plethora of lifeforms. It may well require resorting to superempirical explanations, but not supernatural explanations.

The asymmetry in understanding between the religious and non-religious comes from the fact that religious people know that they have faith in the unprovable and accept that while many non-religious people have faith in the belief that they are not relying on having faith in unprovable beliefs.

All existence and human perception starts with superempirical or supernatural assumptions. The religious understand that and many religious people perceive and understand the contortions that many non-religious people go through in order to convince themselves that they don't rely on superempirical assumptions. Because those non-religious people are so busy with their contortions they don't notice the religious people on the sideline staring at them and laughing.

Category: cat_religion

Wednesday, October 26, 2005

Another Quote

"The great obstacle to discovery is not ignorance, it is the illusion of knowledge." Daniel J. Boorstein

Tuesday, October 25, 2005

Falling Behind in Science

Aviation Week and Space Tech (Oct 17, 2005, page 23) reported that last year US graduated 70,000 engineers. India had 350,000 and China 600,000. 59 percent of US engineering PhDs went to foreign nationals in 2003.In addition, the scientific establishment in the United States continuously bitches and moans that we're not funding enough scientific research.

Coming engineer shortage will be hard on US defense industry who must hire US Citizens with clearances.

So who's to blame? According to the scientific and academic establishments and talking heads, the blame can be placed squarely at the feet of those ignorant and backwards Red-Staters who shun science and all things rational. Indeed, the morons want to teach Creationism or Intelligent Design in their public schools. How awful!

I have a different perspective. It looks to me like the science educators in this country have put a big sign up on all of the science classrooms that says, "Those with religious beliefs are not welcome here!" It looks to me like the scientific establishment would much prefer to advocate anti-religious ideology than to actually have more students interested in science.

A person's belief system is often his or her most prized position. We can argue about whether or not that would be true in an ideal world, but it is true in this one. If the choice is between learning scientific knowledge that contradicts one's belief system and avoiding science, the choice is an easy one for many people - they will simply be uninterested in learning science. In addition, they're probably not going to be particularly interested in funding science either.

Yet, it would be no big trick to teach science in a religion friendly way. First, greatly reduce and/or skip over historical science topics (Paleontology, Archaelogy, Common Descent, etc.) while emphasizing science that focuses on technology going forward. Most of the conflict between science and religion centers on explanations of the past. The past is past, no reason to waste time explaining it in scientific terms to those who are hostile to the concept. Even though some people think otherwise, I think there is little, if any, historical science that's required as a foundation for forward looking science. For example, a while back, I had the following conversation with Jim Hu, a biologist from the Texas A&M, in the comments to a Left2Right post on this very subject.

Me: [N]o understanding of Evolution is required to understand the process for creating GMOs. DNA, transcription, and gene splicing...In other words, if you assume, as Jim Hu does, that Common Descent is True, then of course the differences in DNA between related lifeforms is closely coupled with Common Descent. However, there is no need to believe or understand Common Descent via Evolution to be able to understand transcription and the like, and it's possible to be a perfectly good scientist without knowing about or believing Common Descent.

Jim Hu: Our ability to build the trees [to understand transcription] is based in part on inferences about different rates of mutation at selected and unselected sites in the DNA, and the predictions of models built on these evolutionary inferences ...

Me: When you say "different rates of mutation", how does that differ from saying "accumulated mutations", and how do both of those differ from just saying that "the DNA is different by some amount"? Lastly, is the word "evolutionary" required? For example, could I rewrite your sentence as "Our ability to build the trees is based in part on how much the DNA differs at selected and unselected sites, and the predictions of models built on these inferences..." and still have the same meaning?

Jim Hu: You could certainly rewrite the sentence that way.

A second way to make science more palatable for the religious is to add religion friendly (and non-scientific) components such as Intelligent Design to schools' curriculums. In my opinion, the debate about whether Intelligent Design is science completely misses the point. Assume Intelligent Design is junk. Let's say during ten percent of science class you teach non-science junk as science. Then the students will be taught 90% science and 10% junk. That seems to me far better than 0% science, which is what you get if you refuse to allow Intelligent Design and other religion friendly topics to be taught.

Also, I think it's important to emphasize that theories are models that describe phenomena and ensure that it's clearly taught that the models are not necessarily the same thing as reality or even an accurate reflection thereof. Science is not inherently about reality. Science is about explaining observable phenomena and the explanations may not match the underlying, unobservable phenomena (and all historical science, is by definition, not directly observable). This is an important, but subtle, difference. In one case it's an ideology (and generally anti-religious nowadays) and in the latter case it's an important tool.

Teach the tool using any means available, skip the ideology, and we won't fall behind (as quickly) in science.

Thursday, October 20, 2005

Won't He Ever Learn...

U.S. Sen. Edward Kennedy attempted to rescue six men who had become trapped by high tide on a jetty off Hyannisport on Sunday. The Massachusetts Democrat eventually left the rescue to Hyannis firefighters [...]Well, I guess that's a major improvement relative to the last time he was involved with other people and water.

Kennedy and a friend tried to rescue the men using a 13-foot boat but rough waters forced them back.

Wednesday, October 19, 2005

I Think Therefore They're Not

The world they describe is dark and foreboding with huge numbers of conspiracies of not just politicians and business, but also of the gods themselves, where every attempt to do good things in a manner favored by non-Leftists is bound to backfire and cause further catastrophies. Peter Burnet at Brothers Judd sums it up eloquently when he wrote:

One of the more corrosive rhetorical tools of the modern left is to argue as if life were just one big enactment of Murphy’s Law and that the values revered by most Americans, while perhaps inoffensive or even admirable in themselves, result in the opposite of what their pursuit intends. By linking sweeping and declarative propositions, none of which withstand critical analysis but which flow together with a certain poetic elan, these guys present a world where wealth creates poverty, family breeds abuse and dysfunction, progress destroys the planet, military strength translates into impotence and every accretion of American prosperity and influence sows the seeds of a tragic decline. It all plays on the innate decency of Americans and adds up to an effort to undermine the pragmatic optimism and moral simplicity that undergirds their spirit, a spirit that can indeed lead to naive folly, but which is the source of a success and strength that seems to grow steadily, to the consternation of sages from more philosophical and nuanced lands.

Opening my eyes and looking about I see that the world generally does not work by Murphy's Law. Simple incentives and actions generally lead to the results one would expect. The world of truthout.org, commondreams.org, democraticunderground.com, etc., where every action produces the exact opposite result than what is expected, is not the world I live in.

Tuesday, October 18, 2005

Accelerating Productivity?

Ray Kurzweil recently wrote a book called "The Singularity is Near". His premise is that the rate of development of new technology is increasing at an exponential rate. When a rate (which is already a geometric unit) grows exponentially, you can get a situation where what seems to be rather steady growth suddenly reaches a point where that growth explodes upward with little warning. That point is Kurzweil's Singularity and he thinks it's coming soon (in 2045 to be exact).

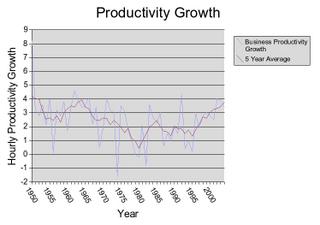

Economist Arnold Kling thinks he sees evidence that it's coming. He cites an article from the Federal Reserve Bank of San Francisco titled "Gains in U.S. Productivity: Stopgap Measures or Lasting Change?" as evidence that the productivity growth rate might be accelerating as shown in the following graph:

The article contains the following statement:

"The performance of productivity in the U.S. economy has delivered some big surprises over the last several years. One surprise was in the latter half of the 1990s, when productivity growth surged to average an annual rate of over 3%, more than twice as fast as the rate in the previous two decades. A bigger surprise has been the further ratcheting up ... productivity growth averaged around 3.8% for the 2001 through 2004 period."Sounds great. Productivity growth is rising. But what's misleading about the numbers is that they've shown a very short time frame. The following is a graph I've created representing a longer timeframe for productivity growth:

Since productivity growth (the blue line) varies so much, I've created a five year average (the red line) so it's easier to see the trends. What's clear is that productivity growth was just as high or higher 50 years ago than it is now, even with the increases touted by the FRB article.

Since productivity growth (the blue line) varies so much, I've created a five year average (the red line) so it's easier to see the trends. What's clear is that productivity growth was just as high or higher 50 years ago than it is now, even with the increases touted by the FRB article.It seems to me that the simpler explanation for the recent rises in productivity growth is that we're finally recovering from the drag on the economy caused by the disastrous policies of Johnson (Vietnam war build and Great Society) and Nixon (bizarre Keynesian monetary/fiscal policies, price freezes, etc.). Note that the peak productivity growth in 1964 coincides with the beginning of the implementation of Johson's policies; that the slide in productivity growth continues with Nixon, Ford, and Carter; that productivity growth finally turns around and starts climbing with Reagan; and that it is finally attaining levels similar to what were seen fifty years ago. The damage Johnson and Nixon were able to do is pretty impressive. Over the last few years I've come to the conclusion that Nixon was easily last century's worst president.

Anyway, I've been unable, so far, to find any solid (or even not-so-solid) evidence that there is any sort of exponential acceleration in any of the economic trends. I'm still hoping Kurzweil or Kling or someone else discovers some convincing data, but so far everything has fallen short of my expectations and needs. Part of my support for federal budget deficit spending was this concept of accelerating growth rates. Without it, my models are definitely less supportive of deficits.

Of course, Kurzweil (and Kling) may still be right. There are many factors that might still mask the presence of accelerating growth in the data. For example, productivity growth is pretty good considering government regulation is orders of magnitude more oppressive than it was fifty years ago. Perhaps there's an accelerating overstatement of inflation which would lead to progressively smaller GDP and productivity growth rates (I'm still working on this one as a real possibility). Perhaps we've all gotten lazier over the last fifty years. Perhaps, perhaps, perhaps. Unfortunately, it's awfully hard to rely on and/or model perhapses. And since I'm a modeling kinda guy, I'm unhappy.

Update: I emailed Arnold Kling regarding the above comments about his article. His response:

One has to look at all of the possibilities and take a point of view. For more references on this topic, see http://www.federalreserve.gov/boarddocs/speeches/2005/20050119/default.htmNot a real strong answer, by any means. The referenced article does not compare the present situation with that of fifty years ago, so I remain unconvinced.

Thursday, October 13, 2005

You Are Here

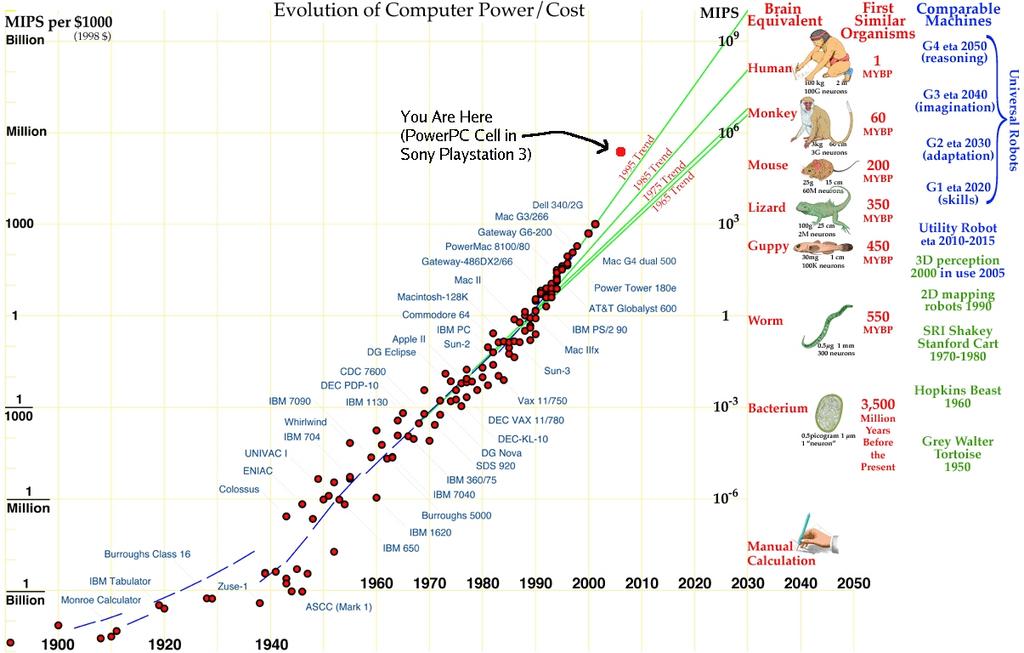

For those of us in the robotics and machine vision business, this is big news. Very big news. Because not only is it an order of magnitude faster per cost than anything else for its niche, its niche happens to be very well suited for machine vision and robotics. Just when I was thinking that Moore's law was stalling out, this comes along. For amusement, I've plotted it on one of my favorite Moore's law related charts done by Hans Moravec (a famous roboticist and author of Robot: Mere Machine to Transcendent Mind).

Admittedly, it's not quite accurate since Moravec only plots general purpose computers, and at first blush the CELL is somewhat specialized - it's really optimized to crunch a lot of numbers. On the other hand, intelligence can emerge from a huge amount of raw number crunching. That's true at least in the area of machine vision. This is enough processing power to crunch through 60 frames per second for each of several high resolution cameras and that's good enough to "see" quite well - not quite human level, but almost. Indeed, as the graph shows, robots with a couple of these processors will be able to achieve the intelligence of somewhere between a mouse and a monkey. And we're on course to achieve the computing capability required for human level intelligence by 2030 (though the software may take substantially longer).

Wednesday, October 12, 2005

Do incentives matter?

Why Do Americans Work More Than Europeans?

By EDWARD C. PRESCOTT

October 21, 2004; Page A18

Last week, The Wall Street Journal published a story describing a new method of measuring a nation's progress – "gross national happiness1." Maybe it's because we're nearing the end of an election season, but one hopes that this indicator does not catch on. Of all the promises that candidates find themselves making, and of all the problems they pledge to fix, one shudders at the notion of pledges to make us happier. The mind reels at the thought of the ill-conceived policies that would be concocted if the stated goal were to increase gross national happiness. It's hard enough to make everybody more prosperous, educated and healthy, but imagine if the government was responsible for keeping you in a good mood. And just think about the data problems.

I mention this not to poke fun at the idea of happiness. Indeed, our Constitution, in its elegant wisdom, allows for individuals to pursue happiness. But individual pursuit is far different from the aggregate management of happiness. This point is at the core of how we should think about many government policies, especially tax policy, which is the subject of this essay.

* * *

Let's begin by considering a commonly held view which says that labor supply is not affected by tax rates. This idea holds that labor participation would remain steady when tax rates are either raised or lowered. If you are a policy maker and you subscribe to this, then you can confidently increase marginal tax rates as high as you like to attain the revenues you desire. Not only that, but you can move those tax rates up and down whenever you like and blithely assume that this will have no effect on output.

But economic theory and data have come together to prove this notion wrong, and we have many different laboratories -- or countries -- in which we can view live experiments. The most useful comparison is between the U.S. and the countries of Europe, because these economies share traits; but the data also hold when we consider other countries (more on those later).

This issue is encapsulated in one question that is currently puzzling policy makers: Why do Americans work so much more than Europeans? The answer is important because it suggests policy proposals that will improve European standards of living (which should give a boost to its gross national happiness, by the way). However, an incorrect answer to that question will result in policies that will only exacerbate Europe's problems and could have implications for other countries that are looking for best practices.

Here's a startling fact: Based on labor market statistics from the Organization for Economic Cooperation and Development, Americans aged 15-64, on a per-person basis, work 50% more than the French. Comparisons between Americans and Germans or Italians are similar. What's going on here? What can possibly account for these large differences in labor supply? It turns out that the answer is not related to cultural differences or institutional factors like unemployment benefits, but that marginal tax rates explain virtually all of this difference. I admit that when I first conducted this analysis I was surprised by this finding, because I fully expected that institutional constraints are playing a bigger role. But this is not the case. (Citations and more complete data can be found in my paper, at http://www.minneapolisfed.org/2.)

Let's take another look at the data. According to the OECD, from 1970-74 France's labor supply exceeded that of the U.S. Also, a review of other industrialized countries shows that their labor supplies either exceeded or were comparable to the U.S. during this period. Jump ahead two decades and you will find that France's labor supply dropped significantly (as did others), and that some countries improved and stayed in line with the U.S. Controlling for other factors, what stands out in these cross-country comparisons is that when European countries and U.S. tax rates are comparable, labor supplies are comparable.

And this insight doesn't just apply to Western industrialized economies. A review of Japanese and Chilean data reveals the same result. This is an important point because some critics of this analysis have suggested that cultural differences explain the difference between European and American labor supplies. The French, for example, prefer leisure more than do Americans or, on the other side of the coin, that Americans like to work more. This is silliness.

Again, I would point you to the data which show that when the French and others were taxed at rates similar to Americans, they supplied roughly the same amount of labor. Other research has shown that at the aggregate level, where idiosyncratic preference differences are averaged out, people are remarkably similar across countries. Further, a recent study has shown that Germans and Americans spend the same amount of time working, but the proportion of taxable market time vs. nontaxable home work time is different. In other words, Germans work just as much, but more of their work is not captured in the taxable market.

I would add another data set for certain countries, especially Italy, and that is nontaxable market time or the underground economy. Many Italians, for example, aren't necessarily working any less than Americans -- they are simply not being taxed for some of their labor. Indeed, the Italian government increases its measured output by nearly 25% to capture the output of the underground sector. Change the tax laws and you will notice a change in behavior: These people won't start working more, they will simply engage in more taxable market labor, and will produce more per hour worked.

This analysis has important implications for policy -- and not just for Europeans, but for the U.S. as well. For example, much has been made during this election season about whether the current administration's tax cuts were good or bad for the economy, but that is more a political question than a policy consideration and it misses the point. The real issue is about whether it is better to tweak the economy with short-lived stimulus plans or to establish an efficient tax system with low tax rates that do not change with the political climate.

What does this mean for U.S. tax policy? It means that we should stop focusing our attention on the recent tax cuts and, instead, start thinking about tax rates. And that means that we should roll back the 1993 tax rate increases and re-establish those from the 1986 Tax Reform Act. Just as they did in the late 1980s, and just as they would in Europe, these lower rates would increase the labor supply, output would grow and tax revenues would increase.

Now, might there be a small increase in debt as we move to a better tax system? Sure, but remember that the most important measure of debt is privately owned government debt as a percent of gross national income, which has been flat over the past three years. Also, there is a sure-fire way to handle this increase in debt, and that would be to cut expenditures. Actually, there is another way to handle it, and that would be to pray to the Gods for another high-tech boom and the debt would go "poof," and we'll praise whoever is president for being fiscally responsible.

Some say that the 1993 tax-rate hike was responsible for erasing this country's debt problems because it increased government revenues. This is false. The ratio of U.S. debt to gross national income continued to increase in the years following those rate hikes and did not fall until the fortuitous boom that occurred in the late '90s. The high-tech boom meant that people worked more, output increased, incomes climbed and tax revenues followed suit. You cannot tax your way to that sort of prosperity. Imagine the outcome of the late-'90s boom if tax rates had been lower. And by the way, lower tax rates are good for all taxpayers. We're barking up the wrong tree if we think that "taxing the rich" will solve all our problems. You know who these rich people are? They're often families with two professional wage-earners. If you tax that family too much, one wage-earner will drop out, and that's not only bad for the income of that family but also for the output of the whole economy -- and will result in lower tax revenues.

Also, we need to get away from thinking of the rich as some sort of permanent class. Many of the individuals who show up on annual millionaire lists, for example, are people who happened to have a good year and who may never appear on that list again. Consider people who worked hard for many years and built a successful business that finally goes public. The big capital gain they realize that year is really compensation for the uncompensated effort they put into building the business. They should not be penalized for their vision and tenacity. If we establish rules that punish the winners, entrepreneurs will take fewer risks and we will have less innovation, less output, less job growth. The whole economy suffers under such a scenario -- not just those few individuals who are taxed at a higher rate. And this doesn't just involve the Googles and Apples and Microsofts, but countless other companies that start small and end up making large contributions to the economy.

The important thing to remember is that the labor supply is not fixed. People, be they European or American, respond to taxes on their income. Just one more example: In 1998, Spain flattened its tax rates in similar fashion to the U.S. rate cuts of 1986, and the Spanish labor supply increased by 12%. In addition, Spanish tax revenues also increased by a few percent.

And that brings us back to our framing question about the labor supplies of the U.S. and Europe: The bottom line is that a thorough analysis of historical data in the U.S. and Europe indicates that, given similar incentives, people make similar choices about labor and leisure. Free European workers from their tax bondage and you will see an increase in gross domestic product (oh, and you might see a pretty significant increase in gross national happiness, too). The same holds true for Americans.

Mr. Prescott is co-winner of the 2004 Nobel Prize in Economics, senior monetary adviser at the Federal Reserve Bank of Minneapolis and professor of economics at Arizona State University.

| URL for this article: http://online.wsj.com/article/0,,SB109830788286551061,00.html | |

| Hyperlinks in this Article: (1) http://online.wsj.com/article/0,,SB109716629151639303,00.html (2) http://www.minneapolisfed.org/ |

Copyright 2004 Dow Jones & Company, Inc. All Rights Reserved

Saturday, October 08, 2005

Faith Based Economics

I recently had someone retort the following regarding the lack of overwhelming data:

"In the absence of data, isn't this just faith-based economics, then? Why should we lend credence to the idea?"The inevitable follow-on mocking comment came as well:

"Why not intelligent design economics?"In some sense, they're right. We can think about how economic interactions might work, we can create models of those interactions, and we can consider and hypothesize the effects of various policies on those models, but without actual, statistically significant data, which will probably never exist, a leap of faith is required to actually pull the trigger and implement any economic policy.

The faith based, Intelligent Design approach to economics actually has a long and interesting history. I'll jump into the story with Marx, the ultimate Intelligent Designer. Since Marxism hadn't, by definition, been tried before Marx invented it, there was absolutely no data available to support it. Nonetheless, dozens of countries embraced Marxist forms of government, leading to tens of millions dead, hundreds of million in poverty (at least using the levels defined by the U.S. Census Bureau), and billions oppressed over a span of decades, before mostly collapsing over the last couple of decades. Even here, with fairly consistent data, it's still impossible to prove that the Central Planning required by Marxist forms of government lead to poorly performing economic systems. After all, maybe all those instantiations of the Marxist approach were all poorly done, and if they had been done right, utopia would have been achieved as promised. Many people still believe that - they're keeping the Marxist faith.

As the economy started heading into a recession after the 1929 stock market crash, tax receipts dropped. Then,

Obsessed about deficits, Hoover had raised individual tax rates at all income levels -- the top rate rose from 25 percent to 63 percent. Following Hoover, Roosevelt signed into law a series of tax increases. At the bottom end, personal exemptions were reduced and an earned income credit was eliminated. At the top end, the highest marginal rate was increased to 79 percent in 1936.The depression deepened and went on and on. Did any historical data support the idea that raising taxes as the country slid into a recession and then depression was a good idea? No, none whatsoever. But Hoover and FDR had faith that it was critically important to try and balance the budget. Of course, we can't prove with certainty that raising taxes made the depression worse. Perhaps people were so tired of roaring away through the 1920s that they simply needed to be depressed for an entire decade. And then after the 1930s was over, maybe it wasn't the largest deficits (as a percentage of GDP) that this country has ever experienced (Reagan and Bush deficits are tiny by comparison) that stimulated the economy out of the depression, rather people were just finally ready to be over being depressed. Certainly, there are many people who believe Hoover's and FDR's tax increases didn't increase the depth or length of the depression and/or the deficits incurred for WWII didn't help the economy recover - they're keeping the pro-taxation and anti-deficit faith.

President Lyndon Johnson declared a war on poverty. He pushed many "Great Society" programs through congress that were Intelligently Designed to eradicate poverty. Many of these programs still exist today. While there aren't a lot of poverty statistics prior to Johnson's declaration of war, when he left office in 1969, the poverty rate (as defined by the measurements his administration developed) was 12.1 percent. The poverty rate fluctuated within a fairly narrow band throughout the 1970s. When President Carter left office 12 years later in 1981, the poverty rate was 14.0 percent. At the end of 2004, it's 12.7 percent. This data hardly demonstrates that the War on Poverty was a resounding success. However, there's no doubt that other factors could have overwhelmed the possible benefits of the War on Poverty. And indeed, a large number people remain convinced that such programs are extremely beneficial - they're keeping the help-the-poor-thru-federal-government-programs faith.

President Nixon decided that the Keynesian economic approach was just what the country needed to really rev up the economy. The data didn't provide a lot of support for the concept, but he got the Fed to loosen the money supply while allowing tax bracket creep to increase effective tax rates in the hope that inflation would be kept in check. As usual, there's not enough data to prove that Nixon's policies led to the stagflation that enveloped the rest of the 1970s and brought down two presidents (Ford and Carter). And no doubt Nixon did not intend for that to happen - but he no lack of faith in his policies.

And then talk about faith - how about Reagan, Laffer, and those supply-siders? When I first heard the supply-side concept, I thought it was, by far, the stupidest economic policy I'd ever heard. I likened it to friends of mine who were convinced that if you left work later allowing rush hour traffic to subside, you'd get home earlier. But the economic data wasn't so bad after Reagan's policies were instituted. The economy improved and business cycles have been pretty mild ever since. Of course, there are too many other factors that could explain the economic turn around. It could be that Reagan's charisma just got everybody fired up. Maybe demographic trends were the main undergirding of the economic turn around. The personal computer was just invented, so maybe the economic improvement was mostly due to technology. Or maybe after 1970s, everybody was just ready to be productive again. Lots of people maintain that it was other factors like these that revived the economy and not the supply-side policies - they're keeping the anti-supply-side faith.

An awful lot of credence has been assigned to awful lot of economic policies throughout the ages with not a lot of supporting data. It seems the best anyone can hope for is to specify policies for which there is no contradicting data. Perhaps, with a lot of luck, policies for which the data is at least somewhat aligned can be tried.

That's the best anyone can do and I have no interest in being held to a higher standard. I write about economic policy not because I expect to convince anyone else, but to point out that there are other ways of looking at economic policy.