Ray Kurzweil recently wrote a book called "The Singularity is Near". His premise is that the rate of development of new technology is increasing at an exponential rate. When a rate (which is already a geometric unit) grows exponentially, you can get a situation where what seems to be rather steady growth suddenly reaches a point where that growth explodes upward with little warning. That point is Kurzweil's Singularity and he thinks it's coming soon (in 2045 to be exact).

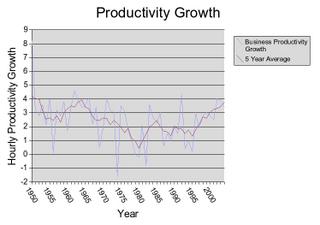

Economist Arnold Kling thinks he sees evidence that it's coming. He cites an article from the Federal Reserve Bank of San Francisco titled "Gains in U.S. Productivity: Stopgap Measures or Lasting Change?" as evidence that the productivity growth rate might be accelerating as shown in the following graph:

The article contains the following statement:

"The performance of productivity in the U.S. economy has delivered some big surprises over the last several years. One surprise was in the latter half of the 1990s, when productivity growth surged to average an annual rate of over 3%, more than twice as fast as the rate in the previous two decades. A bigger surprise has been the further ratcheting up ... productivity growth averaged around 3.8% for the 2001 through 2004 period."Sounds great. Productivity growth is rising. But what's misleading about the numbers is that they've shown a very short time frame. The following is a graph I've created representing a longer timeframe for productivity growth:

Since productivity growth (the blue line) varies so much, I've created a five year average (the red line) so it's easier to see the trends. What's clear is that productivity growth was just as high or higher 50 years ago than it is now, even with the increases touted by the FRB article.

Since productivity growth (the blue line) varies so much, I've created a five year average (the red line) so it's easier to see the trends. What's clear is that productivity growth was just as high or higher 50 years ago than it is now, even with the increases touted by the FRB article.It seems to me that the simpler explanation for the recent rises in productivity growth is that we're finally recovering from the drag on the economy caused by the disastrous policies of Johnson (Vietnam war build and Great Society) and Nixon (bizarre Keynesian monetary/fiscal policies, price freezes, etc.). Note that the peak productivity growth in 1964 coincides with the beginning of the implementation of Johson's policies; that the slide in productivity growth continues with Nixon, Ford, and Carter; that productivity growth finally turns around and starts climbing with Reagan; and that it is finally attaining levels similar to what were seen fifty years ago. The damage Johnson and Nixon were able to do is pretty impressive. Over the last few years I've come to the conclusion that Nixon was easily last century's worst president.

Anyway, I've been unable, so far, to find any solid (or even not-so-solid) evidence that there is any sort of exponential acceleration in any of the economic trends. I'm still hoping Kurzweil or Kling or someone else discovers some convincing data, but so far everything has fallen short of my expectations and needs. Part of my support for federal budget deficit spending was this concept of accelerating growth rates. Without it, my models are definitely less supportive of deficits.

Of course, Kurzweil (and Kling) may still be right. There are many factors that might still mask the presence of accelerating growth in the data. For example, productivity growth is pretty good considering government regulation is orders of magnitude more oppressive than it was fifty years ago. Perhaps there's an accelerating overstatement of inflation which would lead to progressively smaller GDP and productivity growth rates (I'm still working on this one as a real possibility). Perhaps we've all gotten lazier over the last fifty years. Perhaps, perhaps, perhaps. Unfortunately, it's awfully hard to rely on and/or model perhapses. And since I'm a modeling kinda guy, I'm unhappy.

Update: I emailed Arnold Kling regarding the above comments about his article. His response:

One has to look at all of the possibilities and take a point of view. For more references on this topic, see http://www.federalreserve.gov/boarddocs/speeches/2005/20050119/default.htmNot a real strong answer, by any means. The referenced article does not compare the present situation with that of fifty years ago, so I remain unconvinced.

No comments:

Post a Comment