I've been following your blog posts regarding free (international) trade for a decade and I'm wondering what your thoughts are regarding a number of free trade subtopics. If you had time to blog about them, I'd find that interesting and think some of your other readers would too.

Definition of Free Trade

One thing I've never been quite sure of is your definition of free trade. Here's what I get by typing "Free Trade Definition" into Google[google]:free trade noun

noun: free trade; modifier noun: free-trade

1. international trade left to its natural course without tariffs, quotas, or other restrictions.Is that the definition you have in mind when discussing free trade? The rest of this letter assumes so.

Efficiency of Tariffs

According to the definition above, Free Trade and tariffs (where a tariff is a tax) are mutually exclusive. Yet domestic economic transactions are subjected a huge number and wide variety of taxes such as sales taxes, earned income taxes, real estate taxes, estate taxes, capital gains taxes, corporate taxes, health taxes, transportation taxes, and so forth. It doesn’t appear to me that tariffs are any less legitimate than any of the other myriad types of taxes.

In addition, tariffs are a fairly efficient tax in that there are a limited number of ports where goods worth a great deal can enter the country. Compare this to an income tax where a large percentage of more than 300,000,000 individuals in the United States have to file. I’m under the impression that efficiency is why the tariff was historically used to help keep the kingdom’s coffers complete.

Given that libertarians believe that at least a minarchist government is required and even a minarchist government requires some revenue, to the extent that revenues from tariffs can replace the need for other taxes, I don't see why tariffs are any more onerous for an economy and society than any of those other taxes. To me, tariffs seem at least as legitimate and at least as efficient as of the other forms of taxation.

If a majority of the American people and its resultant bureacracy prefer tariffs to other forms of tax, is that really so bad from an economic efficiency point of view?

In addition, tariffs are a fairly efficient tax in that there are a limited number of ports where goods worth a great deal can enter the country. Compare this to an income tax where a large percentage of more than 300,000,000 individuals in the United States have to file. I’m under the impression that efficiency is why the tariff was historically used to help keep the kingdom’s coffers complete.

Given that libertarians believe that at least a minarchist government is required and even a minarchist government requires some revenue, to the extent that revenues from tariffs can replace the need for other taxes, I don't see why tariffs are any more onerous for an economy and society than any of those other taxes. To me, tariffs seem at least as legitimate and at least as efficient as of the other forms of taxation.

If a majority of the American people and its resultant bureacracy prefer tariffs to other forms of tax, is that really so bad from an economic efficiency point of view?

Efficiency Versus Resilience

As a roboticist, I have almost a fetish for electric motors and actuators and the production thereof. While I’ve never visited their factory in China (Hong Kong area), some colleagues that have visited it describe Johnson Electric[johnson] as one of the most awesomely efficient motor production facilities in the world; in one end goes copper ore and other raw materials and out the other end comes millions of motors per day. It’s a shining example of economies of scale and efficiency. Their specialty is automotive electric motors (for power windows, for example) and they produce a significant fraction of all motors worldwide in that niche. If trade restrictions and tariffs were further reduced, no doubt they would have even a larger share of the market and be even more efficient and be able to produce and sell the motors at a somewhat lower cost.

I imagine that part of the appeal of free trade is that there would be many extremely efficient companies like Johnson Electric, each thriving in a specific niche with tremendous volumes, yet with enough competition from a handful of other companies to drive relentless innovation, quality improvement, and cost reduction.

However, there’s potentially a downside to such a scenario. What happens if something happens to Johnson Electric? What happens if there’s political unrest (war), a fire, or a natural disaster?

I find the answer to these questions disconcerting. Examples indicate to me that moderate natural disasters cause significant supply chain disruptions. For example, the 2007 Niigata earthquake [niigata] caused a significant supply chain disruption [farber]:

By now everyone has heard of the M6.8 earthquake up in Niigata last week, a couple of hours north of Tokyo by shinkansen. [...]

One small company in Niigata, Riken (no relation to the research lab with a similar English name, I'm sure) makes 60% of the piston O rings used by *all* of the car manufacturers in Japan. Their plant was badly damaged.

Japan's auto makers, of course, are famed for their "just in time" supply chain management. [...]

Japan's auto makers, of course, are famed for their "just in time" supply chain management. [...]

Toyota was forced to idle at least 27 plants, Daihatsu four, Honda and other manufacturers several each. Toyota is still shut down, as of this writing (Monday, a week after the quake), and has an output loss of 46,000 cars or more.

A 6.8 magnitude earthquake is not a huge natural disaster, especially not for Japan. In fact, this was merely the warm up for the Tohoku quake four years later which caused the tsunami that in turn caused the well publicized Fukushima Daiichi nuclear disaster [fukushima]. What was less publicized was that “[l]ocated in the disaster region and adversely affected by these forces are a number of manufacturing facilities which are integral to the global motor vehicle supply chain” [canis] and that “it took three months for Toyota to recover to its pre-earthquake production level.” [matsuo]

You’d think that Toyota would learn to second source most or all of their supply chain and they do for the most part. But even those companies that are using second sources may be fooling themselves. Second sources might possibly mitigate supply chain disruptions if something catastrophic should happen to Johnson Electric, currently supplying approximately 15% of their niche. But if freer international trade enabled Johnson Electric to double their market share of their niche, it would take months for other suppliers to ramp up to cover for the shortfall due to Johnson Electric’s hypothetical absence.

In most dynamic systems, efficiency is in conflict with resilience and robustness. Redundancy leads to resilience and robustness but is antithetical to efficiency. Those economic ecosystems that utilize Johnson Electric are probably quite efficient, but there’s potentially fragility as well.

Is the fragility worth the little bit of extra efficiency? How much extra efficiency is there or would there be if trade restrictions were further reduced?You’d think that Toyota would learn to second source most or all of their supply chain and they do for the most part. But even those companies that are using second sources may be fooling themselves. Second sources might possibly mitigate supply chain disruptions if something catastrophic should happen to Johnson Electric, currently supplying approximately 15% of their niche. But if freer international trade enabled Johnson Electric to double their market share of their niche, it would take months for other suppliers to ramp up to cover for the shortfall due to Johnson Electric’s hypothetical absence.

In most dynamic systems, efficiency is in conflict with resilience and robustness. Redundancy leads to resilience and robustness but is antithetical to efficiency. Those economic ecosystems that utilize Johnson Electric are probably quite efficient, but there’s potentially fragility as well.

Scale and Free Trade

Clearly, trade has many benefits and limiting it too much can have serious downsides. As your co-blogger Russ Roberts seems to fond of pointing out, “[s]elf-sufficiency is the road to poverty.” [roberts]

However, it seems to me that the incremental advantages of trade diminish as the scale increases. Two people trading with each other are much better off than each doing everything for himself, 100 people are better off trading together rather than just 2 at time, a million are better off than 100, etc., but it seems that the incremental gains slow down with each increase in order of magnitude of people trading and it may even break down at some point. Sure, perhaps it's better to have 160 different brands of shampoo rather than the current 80 most popular brands [brandes], but it doesn't seem like those sorts of advantages are overwhelmingly important.

Consider the approximately half billion people in the North America Free Trade Area (NAFTA). It contains labor from first and third world countries, at least some of nearly all natural resources required for any economy, and extensive diversity of people and geography. I think that NAFTA and the trade that occurs within it is a good thing and very beneficial for the countries that are members.

How beneficial is the additional trade with countries outside of NAFTA for those within NAFTA? Is that even quantifiable?

Chaos and Trade

As we expand beyond NAFTA, I wonder if the adverse effects of the chaotic nature of trade begin to overwhelm the benefits of specialization and economies of scale provided by trade. The chaotic nature seems to me like a waterbed with baffling: without baffling, I jump in and the waves eject my wife onto the floor; yet with baffling, the bed still readily adapts without disturbing my wife's sleep.

A description of the chaotic nature of markets is provided by Professor David Ruelle in his book Chance and Chaos[ruelle]:

A standard piece of economics wisdom is that suppressing economic barriers and establishing a free market makes everybody better off. Suppose that country A and country B both produce toothbrushes and toothpaste for local use. Suppose also that the climate of country A allows toothbrushes to be grown and harvested more profitably than in country B, but that country B has rich mines of excellent toothpaste. Then, if a free market is established, country A will produce cheap toothbrushes, and country B cheap toothpaste, which they will sell to each other for everybody's benefit. More generally, the economists show (under certain assumptions) that a free market economy will provide the producers of various commodities with an equilibrium that will somehow optimize their well-being. But, as we have seen, the complicated system obtained by coupling together various local economies is not unlikely to have a complicated, chaotic time evolution rather than settling down to a convenient equilibrium. (Technically, the economists allow an equilibrium to be a time-dependent state, but not to have an unpredictable future.) Coming back to countries A and B, we see that linking their economies together, and with those of countries C, D, etc., may produce wild economic oscillations that will damage the toothbrush and toothpaste industry. And thus be responsible for countless cavities.

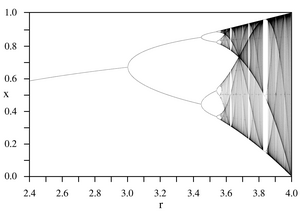

A graphical example of "tipping" points in a chaotic system is shown by the bifurcations in the following graph:

The system is perfect stable for r < 3, enabling a false sense of security and ability to predict the system response for other values. By r = 3.6, the system has become completely unstable and unpredictable with rapid further increases in instability as r increases from there.

There are many real-world physical examples of this such as turbulent versus laminar flow of a fluid in a pipe where linear increases of pump pressure lead to more-or-less linear increases in flow rate until a certain flow rate is hit, after which the flow becomes turbulent and massive increases in pump pressure give little or no increase in flow rate. Eventually the pipe will burst from the pressure.

In the economy, chaotic effects are manifested in things like shifting comparative advantages between regions leading to the collapse of whole industries and sub-economies. Examples include: steel shifting to Asia, gutting the U.S. steel industry and leaving the badly damaged rust-belt in its wake; and accelerated devastation of Appalachia from the changing economic viability of coal and farming. Each of these examples were exacerbated by rent-seeking unions, government and environmental regulations, less than optimal management, technological innovation, and foreign subsidies, but the chaotic nature of markets still played a significant role and these other factors are an inherent part of the chaotic global political economy.

What are the effects of chaos and complexity on Patterns of Sustainable Specialization and Trade [kling] as scale increases?

Because it's such a contentious topic, I could compile a list of a thousand references of various politicians, bureaucrats, and even economists who lament the damage to various groups due to free trade. I'll just list a couple of recent ones.

Charles Murray describes the damage to working class men during the last half century[murray]:

But with much of the United States ecomomy having evolved to services, information, and knowledge, a great deal of the “place” part has been eliminated. Knowledge can move anywhere, often not requiring people to move with it, and often nearly instantaneous.

As a result, I would propose an across the board tariff regime for goods and services coming into NAFTA. I'm not sure what the tariff rate would be and a horde of economists would need to figure that out, but for sake of argument, assume 15%. There would be no other regulations beyond security and military necessity (not allowing importation of nuclear weapons, for example).

This tariff would provide the "baffling" to dampen chaotic behavior of trade. At the same time, any area that truly has a local competitive advantage would still be able to trade with other areas and that would keep trading channels open. Industries would have companies in each of the areas to provide resilience against war and disaster. Knowledge and innovations could still be shared.

Even if none of the benefits above are true, there's not really a large economic downside. The revenue from tariffs would simply offset the revenues from other taxes and those lower other taxes would themselves lead to additional investment and innovation.

Are there other major downsides from an economic perspective? If so, what are those downsides and how big are they?

The main purpose of this email is to hopefully stimulate you to write about these subtopics on your blog in the future from an economic perspective. I would find it interesting and I think some of your other readers will as well.

Thanks,

Bret

Winners and Losers From Free Trade

In the previous sections I have questioned whether or not free trade is even beneficial in aggregate, especially when considering resilience and mitigating the risk of huge supply chain bottlenecks. There is no doubt that some people are better positioned to take advantage of, or at least weather, the effects of free trade. This subtopic is more political than economic, in fact it's a hugely contentious area in the political arena, but whatever light economics can shed on this would still be helpful.Because it's such a contentious topic, I could compile a list of a thousand references of various politicians, bureaucrats, and even economists who lament the damage to various groups due to free trade. I'll just list a couple of recent ones.

Charles Murray describes the damage to working class men during the last half century[murray]:

During the same half-century, American corporations exported millions of manufacturing jobs, which were among the best-paying working-class jobs. They were and are predominantly men’s jobs. In both 1968 and 2015, 70% of manufacturing jobs were held by males.

During the same half-century, the federal government allowed the immigration, legal and illegal, of tens of millions of competitors for the remaining working-class jobs. Apart from agriculture, many of those jobs involve the construction trades or crafts. They too were and are predominantly men’s jobs: 77% in 1968 and 84% in 2015.A recent paper by Autor, Dorn, and Hanson examines the effect of large changes in trade, focusing on trade with China. Here are some excerpts [dorn]

“Employment has certainly fallen in U.S. industries more exposed to import competition. But so too has overall employment in the local labor markets in which these industries were concentrated.”There is little more dangerous to a societal order than substantial groups of people who feel that they have little left to lose. How does one trade of the aggregate economic gains (if any) of free trade with the (alleged) fact that regions and groups have been and will remain devasted? Is any of this quantifiable? In other words, can I know that the likelihood of me losing my job is at least offset by my children being better off due to free trade?

“Without question, a worker’s position in the wage distribution is indicative of her exposure to import competition. In response to a given trade shock, a lower-wage employee experiences larger proportionate reductions in annual and lifetime earnings, a diminished ability to exit a job before an adverse shock hits, and a greater likelihood of exiting the labor market, relative to her higher-wage coworker. Yet the intensity of action along other margins of adjustment means that we will misrepresent the welfare impacts of trade shocks unless we also account for a worker’s local labor market, initial industry of employment, and starting employer.”

“Labor-market adjustment to trade shocks is stunningly slow, with local labor-force participation rates remaining depressed and local unemployment rates remaining elevated for a full decade or more after a shock commences.” While damage to various people in various groups in various regions is not necessarily enough to call for restrictions on free trade, it's also not possible to ignore the political unrest, social ramifications, and potential violence caused by these effects."

Knowledge and Free Trade

The local knowledge problem is described as follows[hayek]:Today it is almost heresy to suggest that scientific knowledge is not the sum of all knowledge. But a little reflection will show that there is beyond question a body of very important but unorganized knowledge which cannot possibly be called scientific in the sense of knowledge of general rules: the knowledge of the particular circumstances of time and place. It is with respect to this that practically every individual has some advantage over all others because he possesses unique information of which beneficial use might be made, but of which use can be made only if the decisions depending on it are left to him or are made with his active coöperation. We need to remember only how much we have to learn in any occupation after we have completed our theoretical training, how big a part of our working life we spend learning particular jobs, and how valuable an asset in all walks of life is knowledge of people, of local conditions, and of special circumstances. To know of and put to use a machine not fully employed, or somebody's skill which could be better utilized, or to be aware of a surplus stock which can be drawn upon during an interruption of supplies, is socially quite as useful as the knowledge of better alternative techniques. And the shipper who earns his living from using otherwise empty or half-filled journeys of tramp-steamers, or the estate agent whose whole knowledge is almost exclusively one of temporary opportunities, or the arbitrageur who gains from local differences of commodity prices, are all performing eminently useful functions based on special knowledge of circumstances of the fleeting moment not known to others.At least some of the argument about need for dispersed knowledge and action thereon has to do with actual local conditions, the “place” part of “time and place.” When a great deal of production has to do with agricultural, extracting energy from the earth, mining, and even manufacturing to some extent, local knowledge is critical for both efficiency and innovation. For example, I work with lettuce growers, and they plant a different lettuce hybrid seed each week to best match the expected weather conditions for that specific 12-week growing period for that batch of lettuce in that specific field. You can't get much more "time and place" specific than that.

But with much of the United States ecomomy having evolved to services, information, and knowledge, a great deal of the “place” part has been eliminated. Knowledge can move anywhere, often not requiring people to move with it, and often nearly instantaneous.

It often seems to me that this globalization of knowledge has almost turned Hayek's knowledge problem on its head. Instead of having an advantage of local knowledge, no individual or local group is able to have an adequate grasp of the competing activities of everyone else around the world, even in a relatively small niche. As a result, no individual or small group can compete without investment risk that's enormous compared with a few decades ago.

I have personally experienced this sort of effect. I may have a high degree of confidence that I'm the only one working on a certain innovation in robotics in a given region, but I'm unable to predict the status of this innovation world wide. Investors, however, want to know if there's a chance they'll be blindsided by some competing group in India, or Israel, or Ireland, or Italy, etc. and if so, will be far less likely to invest. This is exacerbated by the fact that if I'm even nanosecond later than other groups in filing relevant patents, my investors can be out of millions of dollars with no chance to be able to recover from their losses.

As the chaotic effects due to scale increase, investment risk also increases. It's easier to get investment for a venture that can provide a positive ROI and an exit strategy in a short time frame than for ventures that have a longer time horizon. This is partly inherent in the risk assessment and its effect on the subjective discount rate used in Net Present Value calculations which penalize longer time horizons. However, a substantial part of the risk analysis takes the chaotic nature of markets into account coupled with the limited visibility into global activities.

I think that part of slowing of worldwide investment and your colleague Tyler Cowen's Great Stagnation [cowen] are partly due to this sort of phenomenon. There's a lot money sitting, doing nothing, with nobody willing to pull the trigger to invest that money, because that money will be wasted if competing entities are working on the same thing. There are a huge and unlimited number of ventures that can be undertaken, but the risk of doing so due to globalization is astronomical relative to a few decades ago.

Might this new version of the knowledge problem be mitigated by reducing free trade?

Simple Alternative to Free Trade

I'm well aware that putting any sort of trade in the hands of governments and bureaucrats is not without substantial risk due to forces explained by Public Choice Theory[pct] and other factors. Nonetheless, international trade is already in the hands of governments and I think that simplifying government involvement, yet not completely freeing trade, is potentially a tenable approach.As a result, I would propose an across the board tariff regime for goods and services coming into NAFTA. I'm not sure what the tariff rate would be and a horde of economists would need to figure that out, but for sake of argument, assume 15%. There would be no other regulations beyond security and military necessity (not allowing importation of nuclear weapons, for example).

This tariff would provide the "baffling" to dampen chaotic behavior of trade. At the same time, any area that truly has a local competitive advantage would still be able to trade with other areas and that would keep trading channels open. Industries would have companies in each of the areas to provide resilience against war and disaster. Knowledge and innovations could still be shared.

Even if none of the benefits above are true, there's not really a large economic downside. The revenue from tariffs would simply offset the revenues from other taxes and those lower other taxes would themselves lead to additional investment and innovation.

Are there other major downsides from an economic perspective? If so, what are those downsides and how big are they?

Summary

There are a number of issues in various subtopics of free trade that leave me far from convinced that global free trade is a great idea. I understand that "But Freedom!!!!" is a reply that you might respond with to any of the questions above regarding free trade, and I'm not unsympathetic to that response, but that is not an economic argument.The main purpose of this email is to hopefully stimulate you to write about these subtopics on your blog in the future from an economic perspective. I would find it interesting and I think some of your other readers will as well.

Thanks,

Bret

References

[canis] http://www.fas.org/sgp/crs/misc/R41831.pdf

[cowen] http://www.amazon.com/Great-Stagnation-Low-Hanging-Eventually-eSpecial-ebook/dp/B004H0M8QS/ref=sr_1_3?s=digital-text&ie=UTF8&qid=1461494631&sr=1-3&keywords=tyler+cowen

[dorn] http://www.ddorn.net/papers/Autor-Dorn-Hanson-ChinaShock.pdf

[farber] http://seclists.org/interesting-people/2007/Jul/123

[fukushima] https://en.wikipedia.org/wiki/Fukushima_Daiichi_nuclear_disaster

[google] https://www.google.com/webhp?sourceid=chrome-instant&ion=1&espv=2&ie=UTF-8#q=free+trade+definition

[hayek] https://en.wikipedia.org/wiki/Local_knowledge_problem

Friedrich A. Hayek, "The Use of Knowledge", American Economic Review. XXXV, No. 4. pp. 519-30 (1945).

[johnson] https://en.wikipedia.org/wiki/Johnson_Electric[kling] http://arnoldkling.com/essays/papers/PSSTCap.pdf

[matsuo] http://www.sciencedirect.com/science/article/pii/S0925527314002278

[niigata] http://www.japantimes.co.jp/news/2007/07/17/national/powerful-earthquake-slams-niigata

[pct] https://en.wikipedia.org/wiki/Public_choice

[roberts] http://cafehayek.com/2009/04/gifted-in-nepal.html

[ruelle] http://www.amazon.com/Chance-Chaos-David-Ruelle/dp/0691021007/ref=sr_1_1?ie=UTF8&qid=1397157389&sr=8-1&keywords=chance+and+chaos+ruelle

39 comments:

So I'd appreciate all of your input before I send this one off to Don Boudreaux at Cafe Hayek.

I'm looking for anything clearly wrong or anything along these lines that's missing.

I realize that this post may take a long while to chew through. I won't send it to Boudreaux for at least a week so don't feel rushed to get through it.

Even though this is based on an earlier post, it sure took a while to write, and that's a lot of the reason I haven't posted anything else lately. My frequency of posts should pick up again now that this one is outta the way.

Bret, the only reason I don't like tariffs is it interferes with competition. The early 20th century mania for legislating anti-monopoly laws was unnecessary meddling that got the feds foot in the door resulting in the myriad rules and regs that plague today.

Governments need money to function and provide services, but as always, the costs should be borne by those receiving the service or bureaucracy gets out of control as it has now. Probably a flat tax for middle class earners is fair, with an additional tax on high earners.

My husband is a CPA and when he retired friends started asking him to do their taxes and it blossomed into a pretty lucrative second career. One of things he always cautioned people is to not make business decisions based solely on the capricious tax code, but to base their decisions on what's best for their business or in the case of retirees, what's best for their quality of life.

I admire your willingness to get into this morass, but don't worry, if we have freedom, we will always have a Bill Gates taking out the giga-giant IBM from his father's garage.

Hard to imagine, but then in the 50's anyone predicting the internet would have been taken for a lunatic.

Curious what the proponents of Free Trade think about the crippling legislation that has hamstrung business (especially small business ) in many areas of the US....

Barry, you mean all three of us?

erp wrote: "... the only reason I don't like tariffs is it interferes with competition."

Except there are two things that make me think that's not necessarily so.

1. In a trading area with a half billion plus people like NAFTA, the limit to competition will be small (i.e. still plenty of opportunity to internal competition).

2. The chaotic nature of the global economic ecosystem may actually be such that it's counterproductive because capital formation for additional competition may be stymied due to heightened risk.

Barry,

That's one of my frustrations with those that spend a great deal of effort advocating for free trade. If they spent one-tenth the effort on getting rid of that crippling legislation it would have far greater benefit in my opinion.

... and don't forget the unions. Remember after Obama "stimulusized" the auto companies, the first they did was go on strike.

I'm looking for anything clearly wrong or anything along these lines that's missing.

Sorry, I'm a bit late to need. Being on the road almost continuously will have that effect.

Definition of Free Trade: Why is your definition restricted to international trade? The US is composed of more than 50 discreet political units that practice mutual free trade. Why does your definition exclude the US, but include any number of other similar size political entities?

The reason I ask has knock-on consequences, perhaps. I think the phenomena you are seeking to capture is trade absent discriminatory taxes, not whether it is international, or not. After all, the US could, but thankfully does not, have internal tariffs. The consequences of them would be the same as tariffs imposed upon goods from outside the US, so the national/international distinction seems artificial.

Therefore, IMHO, Free Trade is trade not subject to discriminatory taxes or regulations, regardless of its locus.

Efficiency of Tariffs

The issue here isn't whether internal trade is subject to a wide variety of taxes, but that there is no discrimination: all internal trade is subject to the same taxes. Tariffs add an additional, discriminatory, tax. The issue isn't efficiency, or lack thereof, but rather the discrimination. After all, whether the tariff is trivial or ruinous, the efficiency is the same.

Also, I don't think your notion of efficiency is productive. The collection of tariffs seems unlikely to be much more efficient than the collection of any other taxes. Granted, the filing of taxes is a time consuming PITA, but that is aside from the efficiency of collection.

Also, I think your notion that tariff efficiency was used to keep kingdoms coffers full. Imagine a country with one port, and a 100,000 citizens. In pre-modern times, where is the levying of a tax going to be the hardest to avoid?

If a majority of the American people and its resultant bureacracy prefer tariffs to other forms of tax, is that really so bad from an economic efficiency point of view?

Yes, because it isn't efficiency, it is discrimination.

Now, that isn't to say that efficiency, or discrimination, is the only consideration in play, but rather that it is important to decide which.

Efficiency Versus Resilience

Good point on supply chain resilience.

Scale and Free Trade

… but it seems that the incremental gains slow down with each increase in order of magnitude of people trading and it may even break down at some point.

I don't see that at all. Opportunity cost being what it is — transportation isn't free, and has to compete against other goods, for instance — free trade is no more limitless than anything else. After all, there is a control: the US. It has a huge internal free trade market, but it doesn't break down, does it?

Chaos and Trade

I think the difference between a frictionless two country, two commodity, system and the real world is so yuuuuge as to render any conclusions from the model worthless. (In the same sense that climate models are so simplistic, and ignorant of what isn't in the model, that the results they produce are trash.)

Again I return to redefining free trade as all trade not subject to discriminatory taxes or regulations. Intra-US trade has not devolved into chaos (although, as visually persuasive as that diagram is, it baffles me how Prof Ruelle would be able to distinguish between reality and chaos.)

Winners and Losers From Free Trade

No doubt there are winners and losers. But might not the wins and losses not be so much from free trade, as other issues.

I can't believe I'm saying this, given that it appeared in the NYT and includes Joseph Stiglitz, but this article strongly points at least in part in another direction.

Also, the disruptive effects of free trade have, IMHO, much more to do with the sudden dumping of a billion people formerly yoked to that horror that won't die, socialism, onto the world's labor supply. Perhaps, come to think of it, similar to the effect of fracking on the energy market.

If all those countries had been free market economies in the 20th century, instead of dedicated to proving Marx the bane of mankind, then the massive labor market disruption starting in the 1980s wouldn't have happened.

In other words, the consequences of international free trade would likely have been much more like those of national free trade.

Knowledge and Free Trade

Sounds like a testimony to the importance of patents.

And acknowledgment that while some knowledge is particular, much is general. An automatic harvester or pruner will have a great deal of generalized content, with particular adaptations.

Kind of like airplanes.

Anyway, I'm not sure how reducing free trade reduces the globalization of knowledge. Since knowledge isn't bound in space, it can cross borders regardless of the barriers to physical goods.

Ooops. Out of time.

Hey Skipper asks: "Why is your definition restricted to international trade?"

Two reasons: I believe when an economist or pundit talks about "free trade" they are specifically referring to free international trade; that's confirmed by asking google.

Unfortunately, a number of your further comments are based on a different definition for "free trade" (a non-international version). That is indeed why I start the post with the definition to ensure everybody (Don and I) are on the same page. If he rejects my definition, then there's no reason for him to even read further. On the other hand, if he rejects my definition, he'll at least let me know what definition he's using and that would be helpful.

Hey Skipper wrote: "... all internal trade is subject to the same taxes"

If I buy a pack of cigarettes that's subject to different taxes than if I buy a loaf of bread. If I buy a car, that's subject to different taxes than if I trade my labor to someone which is subject to different taxes than if I trade some stock which is subject to different taxes than if I don't buy health care which is subject to different taxes than if I run a business in the city of San Diego which is which is subject to a different set of tax rates than if I run my business just outside of San Diego which is different ...

So no, each type of trade is subject to different taxes. Lots and lots and lots and lots and lots and lots of discrimination in taxes internally.

Even the totality of manufacturing through distribution of a specific widget that's made in two different locales is subject to different sets of taxes (sales tax, for example).

Hey Skipper wrote: "Tariffs add an additional, discriminatory, tax."

Yeah, so? I couldn't care less. Discrimination doesn't bother me in the least. Also, discrimination isn't an economic question, it's a political/moral one, one that's decided by ballots and bullets.

I believe they are efficient and at least as efficient as other taxes (i.e., as I wrote "from an economic efficiency point of view"). That's my question. Perhaps Don (or you?) have some empirical evidence that they are not.

Hey Skipper wrote: "the US. It has a huge internal free trade market, but it doesn't break down, does it?"

It looks to me like it is. Real GDP growth is slowing. Demand for money has cratered. There's Cowen's Great Stagnation. Total employment is sinking. Etc.

Hey Skipper wrote: "...two country, two commodity..."

I think that was an example to describe the problem and not intended to be any sort of "model."

Hey Skipper wrote: "... it baffles me how Prof Ruelle would be able to distinguish between reality and chaos..."

He's putting it forth as a dangerous possibility. Yes, it's very hard to note exactly when the system goes from stable to chaotic behavior.

My question to Don is whether or not the possibility of chaos has been given any sort of consideration.

Hey Skipper wrote: "No doubt there are winners and losers. ... as other issues."

Yes, there are other issues. That's not what I'm asking. Just because there are other issues doesn't mean that free trade has damaged entire regions per Dorn, et al.

Hey Skipper: "... the consequences of international free trade ..."

If we hadn't allowed any international free trade, those regions would not have been devastated. Therefore, it's a consequence of international free trade. And indeed, the chaotic political/social/economic fluctuations of the international scene - a perfect example of chaos in action, no? You can't hope that suddenly every world leader is suddenly going to become sane. Or you can hope it all you want, but it's quite a silly hope in my opinion.

Hey Skipper wrote: "Sounds like a testimony to the importance of patents."

When the ideas behind the GOLEMs (Government Originated Legally Enforced Monopolies) can be created with little capital, then the GOLEMs can possibly be helpful. When it takes a large amount of time and resources to develop those ideas, then my experience is that the GOLEMs are devastating because nobody wants to invest in such a thing because somebody else might beat them to getting the GOLEMs even though they are only very slightly in the lead. I've seen this numerous times in the area of robotics.

I don't know what the solution is though. Only that the much larger knowledge component in a large number of goods and services is causing this problem and adding to some of the stagnation we're seeing.

GOLEMs (Government Originated Legally Enforced Monopolies)

Since it's impossible to imagine that anybody in government has a whimsical sense of humor, I'm guessing this isn't a deliberate pun on golems.

I'm not sure who first coined GOLEM, but I first saw it used by open source advocate Richard Stallman here".

I'd say it's likely he picked that acronym to match the mythical golem.

[Bret:] If I buy a pack of cigarettes that's subject to different taxes than if I buy a loaf of bread.

You have missed my point, which is that free trade is any trade not subject to discriminatory taxes.

Differing taxes whether across types of goods, or between locals, are not discriminatory.

The sales tax on a car purchased in Alaska is zero; in California, nearly 10%. Those are different tax rates. But the sales tax paid on all automobile purchases in CA is 10%, no matter where those cars originate. The CA tax is different than AK's, but neither CA's nor AK's sales taxes are discriminatory.

However, if CA was to increase the sales tax on cars built outside CA to 20%, then that is a discriminatory tax. When considering how free trade is, the main, if not only criteria, are to what degree trade is subject to discriminatory tax, arbitrary regulatory barriers, or other onerous restrictions.

NB: If CA was to impose such a tax, the trade between CA and all other states in the US would become just as burdened as cars originating outside the US — there would no longer be free trade in new cars between CA and Alabama, Kentucky, Michigan, etc.

Of course, your response might well be that CA isn't allowed to do that. True, so far as that goes, but may and can are entirely different things.

Which is why I object to the appellation of international to free trade — it obscures the phenomena about which you are really concerned — discriminatory barriers to trade — with an irrelevant consideration, political borders. It is true, as normal matter, that most trade subject to discriminatory barriers is between countries, rather than within them, but that is descriptive, not prescriptive.

Sticking with a prescriptive description means all trade everywhere comes under consideration. Trade within the US — as free as it is possible to be — counts just as much as trade between the US and the EU. Then the question becomes, if free trade between states is an unalloyed good, why isn't free trade between the US and the EU (for example)?

[Discriminatory taxes don't] bother me in the least.

They should, because they, or their surrogates, are fundamental to any discussion about trade.

It looks to me like it is. Real GDP growth is slowing. Demand for money has cratered. There's Cowen's Great Stagnation. Total employment is sinking. Etc.

If you could attach those phenomena in any meaningful way to internal free trade, then my assertion about a huge internal free market would be vitiated. But you haven't, and, I'll bet, can't.

RE: Prof Ruelle's model.

With something like 250 years of experience, the US's internal free market, by far the largest in the world until the 20th C, never devolved into chaos. This is one good reason to doubt the usefulness of the model.

Second, such a simplistic model is almost bound to be worthless from the get go. A trade system consisting of just 100 items, which is dwarfed by reality, has 100! dependencies; that is a number so large as to be nearly uncomputable, even if you could get all the required measurements, in anything like real time.

What would chaotic trade look like?

If we hadn't allowed any international free trade, those regions would not have been devastated.

Let's presume that to be true, that all the devastation was due solely to free trade. Obviously, then, if we had sufficiently discriminatory trade, the devastation would not have happened, right?

At what cost?

IT has been devastating, too. If devastation is your concern, then we should be impeding IT also, right?

And if not, then why one and not the other?

It's not like I know the answers, only that I think your argument so far runs the risk, due to some unnecessary distinctions, obscuring what you hope to ascertain.

Then the question becomes, if free trade between states is an unalloyed good, why isn't free trade between the US and the EU (for example)?

One of the distortions that occur when we try to assess things like international trade using economic analyses alone is that we get to ignore, not just political reality, but political values as well. Let me respond with another rhetorical question: Why have borders at all? If international cooperation is an "unalloyed good" and we're all fellow passengers on Spaceship Earth, let's make the world one big political and economic unity. Non-stop economic expansions and no more war. What's not to like?

The current wave of protectionist thinking we can see in the primaries raises the question cui bono? To blithely say there will be winners and losers ignores the fact that not all winners and losers are of equal worth in the public square. A New Englander who loses his manufacturing job to Texas or Arizona will accept it, however grudgingly, not because he or she understands it's part of some collective macro-good, but because there is an underlying political unity to the USA that accepts the arrangement as part of the political culture and common loyalties. That's not going to be true about Colombia or Bangladesh.

The Greek crisis showed just how fast support for free trade can evaporate when one party is seen as the loser, especially for structural reasons. The Germans adhered to a banker's' perspective--debts must be repaid--while the Greeks rediscovered nationalism and xenophobia. It was pretty clear to me than the crisis revealed that Europeans simply don't like one another enough to ground the common loyalties and sacrifices needed in a crisis.

We know that free trade correlates with macro-prosperity and growth, but that isn't going to translate into steady public support if all the public sees is shuttered factories at home and growth in foreign lands fueled by penury-level wages, unsafe working conditions and a casual attitude to the rule of law. One can express this cynically by noting that Americans vote and foreigners don't, or more inspirationally by appealing to the common bonds of citizenship and national political culture. Not to mention that citizens aren't one-dimensional "variables" to be inserted into an econometric model. Economists, especially libertarian economists, always forget that man does not live by bread alone.

Peter, you hit the nail on the head: Why have borders at all?

That's the lefty dream. One world with all of us under the tender loving care of the elites.

In the old science fiction books I used to devour, they lived on an aerie in Colorado and rarely mingled with the rest of the folk. I dare say, it's not that different now -- only perhaps the location of the aerie.

[Peter:] One of the distortions that occur when we try to assess things like international trade using economic analyses alone is that we get to ignore, not just political reality, but political values as well.

Exactly.

And not exactly followed by "but", either.

That is the reason I get a bit pedantic about making the terms certain before proceeding. Free trade exists between California and Mississippi, regions with distinctly different economics, and without particular fuss. As well, between Mississippi and Canada, and the EU.

As I suggested above, free trade, properly defined, suggests that the problem with free trade isn't free trade, but societies at wildly different levels of development. Which leads to a moral question: if Chinese lives are as valuable in the grand scheme as Americans', then is it more moral that some areas in the US are economically damaged -- while not being truly impoverished -- so that a couple hundred million Chinese can escape abject poverty?

(My two cents: rate of change matters. Had the opening of China occurred over a century, instead of a decade, then adjustment would be easy; that is why shifts between New England and Texas aren't a big deal; the differences aren't big enough to create rapid change. Two more cents: that free trade is better than the alternative doesn't mean we get to ignore those who are displaced by it.)

Why have borders at all?

Good question, but not an economic one. In Europe it is clear why borders exist, although it is far from clear how the differences in language and custom can persist for so long in such close proximity.

It is less clear why the border between the US and Canada exists, although when it comes down to it, that is nearly a border in name only. Between the US and Mexico is far more obvious: language and culture.

The Greek crisis showed just how fast support for free trade can evaporate when one party is seen as the loser, especially for structural reasons.

Not so much as it showed that the greatest damage to free trade is caused by innumerate or ideologically blinkered government. If the Greeks had been honest about their finances from the outset, they wouldn't have been in the EU in the first place. Had they weaned themselves from the socialist notion that there is such a thing as "free", they wouldn't reached their dire straits.

In order for the German gov't to not take the position it did, it would have to convince hard working, disciplined, Germans that they would have to work harder, and longer, so as to provide hundreds of billions of Euros to Greeks who thought full retirement on 100% salary at 50 is the natural order of things.

I think the crisis revealed a North - South divide in Europe. Greece in particular, and Italy to a lesser extent are shambolic societies that share almost nothing in common with Germany, Finland, the Netherlands, Britain, or even France. Before the EU, they paid for that through weak exchange rates and expensive imports. After joining the EU, and without a central bank worthy of the name, they larded up on debt until they were at risk of becoming Mr. Creosote.

We know that free trade correlates with macro-prosperity and growth, but that isn't going to translate into steady public support ...

For the love of God, why the heck haven't you been running for President? Oh, right. That darn citizenship thing.

Economists, especially libertarian economists, always forget that man does not live by bread alone.

And that trade is about much more than comparative advantage.

I think Bret has done a super job with his analysis, particularly in raising questions of diminishing returns and challenging the article of faith among free-marketers that if one trade agreement is good, two must be better and so on. But I'm really not qualified to critique his analysis and I wonder whether it's even possible to disprove or prove his points empirically, because the trade economy doesn't stand in isolation from general economic issues. However, the political zeitgeist is not favourable and it strikes me that the poobahs of both parties are scrambling to defend it and not very successfully.

It's pretty clear from the primaries that we're seeing a revolt of both protectionism and nativism that is blowing up the GOP and fracturing the Dems. A lot of it is based on nostalgia and romantic thinking, but there is no doubt it is born of economic turbulence, distress and pessimism in the bottom half. I don't buy the leftist argument that the general public yearns for economic equality, but I do believe it is essential to maintain equality of opportunity, a level playing field, etc. When the promise of free markets becomes associated with Wall Street corruption (too big to fail and too big to indict), factories fleeing to Mexico and Asia, massive unpayable student debt, an inexplicable decline in investment and a ho-hum response to job losses and other economic distress, there is going to be a political reaction that won't be assuaged by economic theory, dreamy fantasies of 19th century limited government or appeals to what the Founders thought.

Obviously Trump is rocking the GOP with his heresies, but the Dem establishment is in tough too. In some ways, Trump and Sanders have more in common than they do with their opponents (starting with bases of angry white men). Thomas Frank's criticisms of the Dems as the party of wealthy liberal urban professionals who have abandoned working people and become preoccupied with environmental and identity issues ("Sorry you lost your job. Maybe you and your family should move to Idaho. Now let's talk about degendered bathrooms.") are worth reading, even if his prescriptions aren't.

It's always worried me how easy it is doctrinaire free-marketers and libertarians to wash their hands of responsibility for the losers in their winners and losers game. Even the perception of who they are is malleable. Earlier this winter, pundits across the spectrum expressed some degree on sympathy for Trump's supporters, characterizing them as honest working people trying to juggle two low paying jobs while covering medical and educational expenses for their families. The American Dream was leaving them behind. As Trump rolled on and the GOP panicked, that changed. Kevin Williamson for National Review, who I normally like, led the reaction with a mean-spirited depiction of the typical Trump supporter as an Oxycontin-addled trailer park racist living on a fraudulent disability claim. He kicked the American dream in the privates and wasn't worth defending. If that's the best the GOP can do, no wonder Trump's winning.

So, free trade raises the cui bono question and whether an American worker is entitled to priority over foreign workers. But that question is being asked in a broader context of to what degree we are our brothers' keepers. If conservatives don't get their act together to come up with an appealing answer, we may face a very destructive period of leftist inspired protectionism and autarchy, and it won't matter much to the electorate that those have almost always been recipes for economic stagnation.

Peter,

Would you mind if I promote your last comment to a post? You've written the political half of my trade argument and I'd prefer it doesn't get lost as a comment.

Basically, what I was trying to write was that maybe free trade isn't that big of a winner economically at this point and might actually be detrimental and you've written that politically, socially, psychologically, and emotionally taking a breather from free trade might be what we need.

Hey Skipper wrote: "That is the reason I get a bit pedantic about making the terms certain before proceeding."

And that's why I started the post with the definition to be used in the post and discussion for free trade. That it happens to be the standard definition used by economists, pundits, and google is secondary.

Hey Skipper wrote: "Free trade exists between California and Mississippi..."

By definition that's not free trade. Again, look at the definition at the top of the post.

I'm more than a little frustrated here. You probably have some useful and important comments above that would help with the final draft of the letter, but since you've decided to stick with your own definition, I can't tell which ones they are.

Hey Skipper,

One of your arguments seems to be (though I can't tell for sure because of the definitional quagmire) that if we choose to limit any form of trade it somehow follows that we have to limit all trade. That seems to be one of Don's arguments as well and I've never understood it.

Examples...

This is actually a real example. I have an electronic circuit. It's a great and very efficient circuit and does what's needed. EXCEPT, under certain conditions it goes into a catastrophic chaotic oscillation. It's unknown if these conditions will actually ever happen in reality. I determine that by adding some impedance to the left side of the circuit, I can eliminate the problem. Adding the impedance is discriminatory to the left side of the circuit and the circuit does burn more energy (especially the left side) and is less efficient.

[The circuit is the interface to one of our sensors. If the user forgets to plug the sensor in, without the extra impedance, the board fries itself in short order. With the impedance it is robust but less efficient. We decided to add the impedance.]

There is a pumping system that pumps fluid on demand for many subsystems. It is determined that because of growth in the overall system, if all subsystems demand fluid simultaneously, the flow in the pipes will transition from laminar to turbulent flow, the demand will not be met, and the pipes will potentially burst. There is no time to engineer any sort of limiter to the pump system. Do you: (a) arbitrarily take one or more of the subsystems off line or (b) do nothing because it might not happen and to do something would be discriminatory.

We could, of course, describe such systems until the end of time. And in the vast majority of the cases, the engineers would add the extra impedance, or the flow restriction, or they would take subsystems off line, etc. Even when it's not known that the catastrophic situation will ever necessarily occur.

Restricting some flow in a system where stuff might slosh around chaotically makes sense. Restricting all flow does not.

Sure, Bret, although it's kind of rough. Needs some copyediting too.

Hey Skipper wrote: "if Chinese lives are as valuable in the grand scheme as Americans'"

The "grand scheme?" What the hell is that?

In my scheme, they simply aren't.

Consider the following example. Let's say my daughter was facing death and the only action I could take to save her would clearly result in the death of every last person in China. One never knows what one would do in such a situation requiring a snap decision, but I suspect I would choose my daughter's life. On the other hand, if it was my life versus China, I'm virtually certain I would choose my own death.

But that's immaterial. I think it's a stunning misconception that China needs to trade with the US or NAFTA to thrive. I think the same effects of free trade that are adversely affecting the US are also adversely affecting the Chinese and reducing international trade would make the people of China better off as well.

OTOH, just when you think you have the priorities of the working class all figured out...

... with China's vast population, it doesn't need to trade with us or anyone else. They could take an example of the prosperity of our early industrial age and bring their own people into the middle class.

Peter wrote: "...it's kind of rough..."

Yeah, your "rough" is a polished diamond for mere mortals. I did fix a couple of things though. If I misguessed in my fixes, let me know.

Arriving a bit late, I would like to give my two cents too.

You text is very good in many ways, Bret, but the use of chaos theory to advance your arguments is not helping it, IMHO.

Depending on the system you are talking about, greater chaos makes it more, not less, robust. And none of the obervables you cite ("steel shifting to Asia, gutting the U.S. steel industry ...") can be directly related to chaos in any meaningful way I know of.

Tools of chaos theory are well used to study data series of stock prices, or yet to model competition between industries, or to talk about equilibrium points in economic models - but to relate steel shifting to Asia you have no great need to invoke non-linear phenomena, I guess.

You argument on diminishing returns of free trade is one I've seen mentioned by Krugman a few times. Before you think to be in bad company, I would argue this is the field where he got his Nobel prize and he looks to have a good grasp of it , politics aside. I've noticed Don recently directed many posts against Krugman on this matter of Trade, and so far I am not convinced Don showed better arguments.

Ultimately, if he answers your letter at all, I think he will retreat to principles (Freedom!), even though you tried to preempt that. The questions you pose hardly can be answered with anything better than guesses (like the one I linked from Krugman above), making it easier for people to answer them based on their guts, instead of higher reasoning.

As a last comment, I do not think your proposed solution (an one-size-fits-all tariff) would help much either. You can give yourself the luxury of sacrificing the efficiency of one circuit of a single detector you have in your robotic gardeners, but you would need to think twice before sacrificing a sizable portion of the efficiency of the whole system.

[Bret: ] And that's why I started the post with the definition to be used in the post and discussion for free trade. That it happens to be the standard definition used by economists, pundits, and google is secondary.

I know I'm at risk approaching certainty of repeating myself, but here goes, anyway:

People routinely use terms that have no meaning: what time is 12am?

But the standard definition isn't helpful if it includes irrelevant considerations. Yes, I get that the standard definition throws international in there, but doing so excludes from consideration free trade that isn't international: why is trade between Los Angeles and Portland, ME, not worth talking about, but between Seattle and Vancouver is?

Stripped of the overburden, free trade is trade absent discrimination, in whatever form it might take. Tax discrimination (tariffs) is the most obvious, but onerous inspections, or environmental or labor laws, more or less contrived, are other, just as effective, forms.

The efficiency of discrimination through taxation is a weak argument in favor of tariffs; first, it is difficult to establish the truth of the assertion, and, second, that has to be balanced against the very real problems of trade discrimination: rent seeking, cartels, and regulatory capture.

This, I think, (along with Efficiency v. Resilience) is the greatest argument in favor of non-discriminatory trade.

Then there is the freedom issue: on what basis do these knuckleheads get to tell me from where I can buy sugar? (never mind the damage done to the Everglades). Which rather brings into question your assertion that there are no large economic downsides to tariffs.

If one is to make a case for free trade, then it is dishonest to exclude the very real and often localized effects; similarly, to argue for discriminatory trade requires taking into account all the consequences, not just the putative benefits.

In comparison, the efficiency of taxation is a side show.

BTW, I agree with Peter that unalloyed free trade can, and has, created some very serious problems. (Although, it is very difficult to tell which are due to free trade, IT, or effectively unrestricted illegal immigration. [Yes, NYT, the correct word is "illegal.])

However, having included the rent seeking and regulatory capture that invariably accompanies discriminatory trade, the challenge becomes how to ease trade shocks without multiplying sugar cartels.

I'm with Clovis — chaotic behavior isn't helpful; after all, the system doesn't have to be chaotic for there to be harmful consequences; harmful consequences obtain with discriminatory trade; and, the consequences concerning you most happened without chaotic behavior.

One of your arguments seems to be (though I can't tell for sure because of the definitional quagmire) that if we choose to limit any form of trade it somehow follows that we have to limit all trade.

Apologies, this is a difficult subject to write clearly on. My argument is primarily based upon the rent seeking and regulatory capture that always accompanies discriminatory trade. Sometimes that might be the least worst alternative, but, as the sugar cartel shows, once in place, they are devilishly difficult to extract.

Clovis wrote: "... but the use of chaos theory to advance your arguments is not helping it ..."

Do you disagree with Ruelle, or just my examples?

Clovis wrote: "... before sacrificing a sizable portion of the efficiency ..."

Is it a sizable portion of the efficiency? Why do you think that? I think at the scales we're talking about, it hardly benefits efficiency.

Hey Skipper wrote: "...why is trade between Los Angeles and Portland, ME, not worth talking about, but between Seattle and Vancouver is?"

Since they're all part of NAFTA, there's not much difference, so I'm not sure that's a great example.

I'm perfectly happy to restrict trade between different regions in NAFTA instead of with China if that's what American voters prefer. My point is that I think at least many Americans would suffer far less pain is trade were "baffled" somewhat. It seems to me that it'd be easier to restrict international trade but if everybody would prefer to restrict some domestic trade, fine by me.

Hey Skipper wrote: "...as the sugar cartel shows, once in place, they are devilishly difficult to extract..."

My solution would mitigate sugar protectionism because everything within NAFTA would be exactly equally tariffed/protected, not just sugar.

Bret,

---

Do you disagree with Ruelle, or just my examples?

---

Ruelle didn't present a case, only a (maybe not very well defined) analogy. You present cases, but in none of them it is clear the extent to which non-linear phenomena is relevant.

Let me give you an objective example. One well known case where chaotic dynamics is hugely relevant is the physics of tokamaks.

They build those things trying to reach the holy grail of energy generation: magnetically confined plasma achieving fusion under controlled conditions, i.e. to imitate what the sun does, but here on Earth. The damn thing never works though, because the plasma is pretty hard to confine at such high energies.

One of the main things they've learned, so far, is that under some parameters the chaotic dynamics induced in the plasma actually helps a lot to confine it for a longer period of time.

Back to economics, how are we going to check if the possibly chaotic dynamics of international trade is more like the coupled harmonic oscillators Ruelle mentions, presenting huge and abrupt changes, or that it is more like the plasma in tokamaks, where it create artificial bounds isolating the particles from hitting the walls of the tokamak?

In the first case, your idea of introducing a baffling may sound all the wise, but in the second it sure isn't.

Clovis wrote: "achieving fusion ... The damn thing never works though ..."

Ummm, doesn't the damn thing work just fine? It just requires more energy than it produces and that's just a minor engineering detail, no? :-)

In fact, isn't it almost trivial to fuse stuff?

Clovis wrote: "... under some parameters the chaotic dynamics induced in the plasma actually helps a lot to confine it for a longer period of time."

That actually got me to laugh a little. I was imagining these bits of plasma slam dancing into each other at a gazillion miles an hour, and my experiences slam dancing when I was younger makes me think that adding chaotic dynamics could indeed help near the boundaries to slow those slam dancers down before they careen off the dance floor into the tables of drinkers.

I'm not sure you want economic agents slamming at a gazillion miles an hour and even if you did, it sounds like the chaos was added to slow things at the boundaries (do you have a link understandable by the somewhat scientifically literate layperson?).

Slowing and isolating near boundaries. Hmmm. Sounds sort of like restrictions on free trade at national boundaries, no? Perhaps sorta like the slowing and isolating tariffs would cause? Perhaps adding random tariffs? Yeah, that's the ticket! Random tariffs! That way, with minimal government intervention (i.e. the tariff rates could average a LOT lower), trade would still be adequately slowed! I like it! If I was an economist, I'd write a paper! The title would be "Chaotic Border Tariffs to Reduce Domestic Economic Chaos." :-)

Clovis asks: "...how are we going to check ... ?"

We're not (or at least, I'm not). I'm saying that international trade adds little at the current scale, therefore baffling won't hurt very much if any, and may help. One of the reasons it may help has to do with chaos (along with resilience, etc.) but even if wrong, it's cheap insurance.

So in either case, adding baffling is wise. Yup, that's me, the (dorky) wise one! :-)

Bret,

---

t just requires more energy than it produces and that's just a minor engineering detail, no? :-)

---

Well, when it is your sole objective, I'd say no.

---

Slowing and isolating near boundaries. Hmmm. Sounds sort of like restrictions on free trade at national boundaries, no?

---

The problem of dealing with smart people is they can distort any argument to their side. :-)

So I try another example, the paradox of the plankton:

"In aquatic biology, the paradox of the plankton describes the situation in which a limited range of resources supports an unexpectedly wide range of plankton species, apparently flouting the competitive exclusion principle which holds that when two species compete for the same resource, one will be driven to extinction."

How come those species survive along each other, instead of competing to death?

It turns out a good answer is chaos - the chaotic borders induced by chaotic advection of the ocean:

"Recent developments in the field of chaotic advection in hydrodynamical flows encourage us to revisit the population dynamics of species competing for the same resource in an open aquatic system. If this aquatic environment is homogeneous and well-mixed then classical studies predict competitive exclusion of all but the most perfectly adapted species. In fact, this homogeneity is very rare, and the species of the community (at least on an ecological observation time scale) are in nonequilibrium coexistence. We argue that a peculiar small-scale, spatial heterogeneity generated by chaotic advection can lead to coexistence. In open flows this imperfect mixing lets the populations accumulate along fractal filaments, where competition is governed by an “advantage of rarity” principle. "

IOW, chaos makes the system more stable for life. What's the lesson for Economics? I don't know, but I know an argument like "Oh My God, Chaos!" isn't the best way to sell tariffs.

---

do you have a link understandable by the somewhat scientifically literate layperson?

---

Most papers cite some pretty old 70's stuff, when much of tokamak physics was developed, but I could find something newer, the problem being that you may not have access.

... is chaos another way of saying things are left to sink or swim on their own instead of "geniuses" trying to make everything "fair" and interfering with nature.

The playing field needs to be level for everyone and everything, the rest is up to individuals - who BTW are only equal under the law.

For more details, read Harrison Bergeron.

Clovis wrote: '"Oh My God, Chaos!" isn't the best way to sell tariffs.'

Well, I didn't exactly write OMG Chaos! I think I'll trim back the last two paragraphs of the section, just leaving Ruelle's argument (I love appeal to authority except when other people do it :-) and the cool graph.

And then I ask what I still think is an interesting question: "What are the effects of chaos and complexity on Patterns of Sustainable Specialization and Trade [kling] as scale increases?" And that's a little different than OMG Chaos, no?

Clovis wrote: "...the chaotic borders..."

I'm chuckling that you chose the word "borders," in other words that the chaos induces sort of borders which then enables greater diversity of plankton. So that's what I'm proposing: economic "borders" to enable greater economic diversity.

But ok, I'll shorten the section and just leave it more open ended.

Bret,

I agree, the closing question is pretty good and you would do well in keeping it.

As for "chaotic borders", I mistyped, it should be "fractal borders".

Basically the fractal borders (induced by chaotic advection) enables the planktons to have greater surface contact with the nutrients in the ocean, hence the solution to the paradox.

In that sense, those borders are the opposite of the static economic borders you want to impose with tariffs.

Here is an interesting article showing that growing anti-free trade is by not just an American phenomenon. Note the absence of coherent macro-economic analysis and the reliance on local favourite causes (American food is a health hazard). The irony is that few countries have benefitted as much from liberalized trade as Germany and the States.

Peter, thanks for the link, and your summary is spot on. I couldn't help but notice this, towards the end:

It's hard to know what drives politicians to sell out their people and their country.

That is from a supposed news item, and, near as I can tell, has nothing in the article itself to substantiate the conclusion.

IMHO, the largest problems with free trade are that it is counterintuitive, and its benefits tend to be diffuse.

[Bret:] Since they're all part of NAFTA, there's not much difference, so I'm not sure that's a great example.

D'oh.

I'm perfectly happy to restrict trade between different regions in NAFTA instead of with China if that's what American voters prefer. My point is that I think at least many Americans would suffer far less pain is trade were "baffled" [buffered?] somewhat.

The real problem here is that almost all the arguments against free trade are simple, and wrong, while those in favor are more complicated, and right.

Unfortunately, the alternative to free trade, discriminatory trade, always include costs that are never counted. Agreed, areas in the south were devastated by offshoring clothing production. What kind of tariff would have been required to stop that? Whatever amount is chosen -- how? by whom? -- that is precisely how much more expensive clothing will become, so the tariff becomes a tax on all clothing paid by all consumers as a rent to the clothing industry.

Now, multiply that by all the tariffs rent seekers are hoping to impose.

Peter is right, there is a significant tide against Free trade. It's a shame the alternative is so sucktastic.

Post a Comment