The BEA (Bureau of Economic Analysis) releases three estimates of GDP growth for each quarter. The "advance" estimate comes out toward the end of the first month after the quarter, the "preliminary" estimate comes out toward the end of the second month after the quarter, and the "final" estimate comes out toward the end of the third month after the quarter. Each estimate incorporates additional information as it becomes available and, in theory, should be more accurate.

When comparing the advance estimate to the final estimate, one might think that the difference between the two estimates would be more or less randomly distributed. In particular, one might think that about half of the time the advance estimate would be higher than the final estimate and the other half of the time the final estimate would be higher and that the averages of the estimates would be about the same.

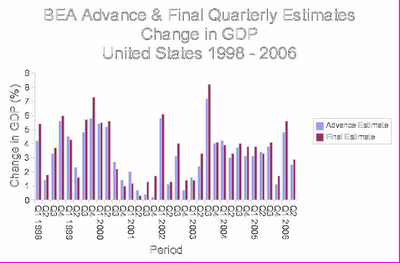

But, as the graph above shows (click to enlarge), that's not the case. In the last 34 periods, the advance estimate has been lower than the final estimate 25 times, while being higher only 9 times. The advance estimate average is approximately 11.3% below the average of the final estimates which represents a delta of 0.34% of GDP. While I haven't run any formal statistical tests on these data, I'm very confident that the delta between the averages and the discrepency between the number of upward and downward revisions is statistically significant given the sample size.

So the BEA's advanced estimate is usually too low. This is apparently built into the formulae used by the BEA to calculate these estimates. I'm sure they follow their methodology consistently and rigidly each and every quarter and that's certainly their job.

But there are a couple things that are interesting here (I'm sure you were hoping something in this rather dry analysis would be interesting). The first is that when you read an article containing an advance estimate, adding 0.34 to it will give you a better estimate approximately 74% of the time (25/34). The BEA could do this same calculation to enhance their estimates, but consistency in the method of calculating the estimate is more important than accuracy. It's easy enough for us to take their estimate and modify it accordingly to make it more accurate.

The second thing of interest to me is that the consistent underestimates coupled with the estimate reporting calendar gives the NY Times and other liberal media yet another opportunity to describe the economy as weakening. Each time the advance estimate comes out, they can compare it to the final estimate for the previous quarter. Because the advance estimate is lower than it should be, on the surface it always looks like the economy is starting to soften more than it actually is (by 0.34% of GDP). So the next time you see a statement in the NY Times that comes out just after the advance estimate becomes available which claims that the economy is starting to soften or that the economy is losing steam, and their evidence for this claim is based on a comparison of the advance estimate and the previous quarter's final estimate, you should probably heavily discount that.

3 comments:

I'm happy with a bias towards lowballing the growth estimates - "underpromise and overdeliver" seems like a good policy in all fields save politics.

You might be interested in this post at The Skeptical Optimist, complete with chart:

"Real GDP is probably growing closer to a 4.2% annualized rate, based on the 2-quarter method for estimating growth. (The 2-quarter method has been a more reliable predictor of GDP growth than the BEA’s 1-quarter method...)"

If a Dem was pres. the NYT and MSM would be telling us that this was the greatest economy in history! Hey "O", Skeptical Optimist is a great source for info. and analysis - I've pointing people there and to Steve Conover's original site.

I do subscribe the Skeptical Optimist. However, I have to say I have some reservations about some of his fundamental analysis. I'll have more to say about this on some (hopefully) upcoming posts.

Post a Comment