Forum for discussion and essays on a wide range of subjects including technology, politics, economics, philosophy, and partying.

Search This Blog

Sunday, September 19, 2010

Ahoy Matey

Thursday, September 16, 2010

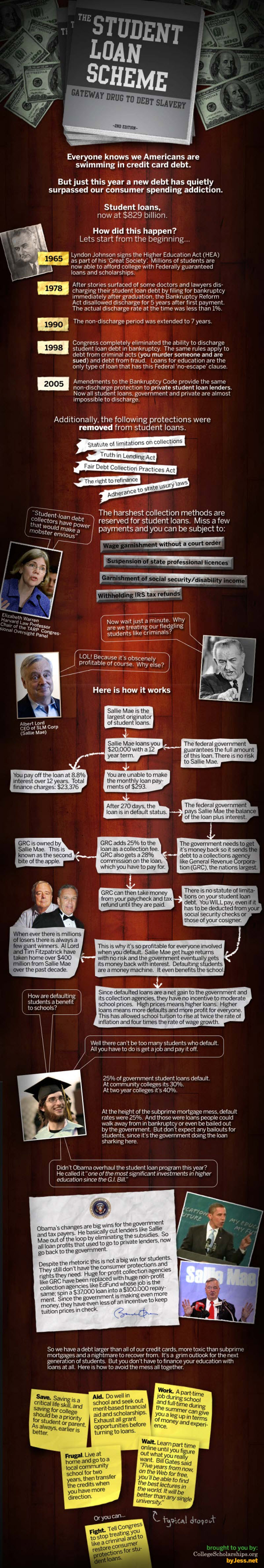

Higher Education Loan Bubble

A whole generation has mortgaged their future (literally). Where are tomorrow's entrepreneurs going to come from if nobody can afford to take risks?

So you want to be simpleminded?

The world is very complex. It generally pays to look at things from many different perspectives drawing upon history, data and theory. My experience is that very few people are willing to do that, especially in a political discussion. Well, if anyone insists on being simpleminded...

via redstate

h/t instapundit

Wednesday, September 15, 2010

Flawed Metrics

Our key insight is a pessimistic one: this is the sort of situation which, though individuals and markets don’t handle it well, isn’t actually handled well by governments either. The fundamental mistake of statist thinking is to juxtapose the tragically, inevitably flawed response of individuals and markets to large collective-action problems like this one against the hypothetical perfection of idealized government action, without coping with the reality that government action is also tragically and inevitably flawed. [...]In other words, don't take imperfect and possibly even very bad situations and make them even worse because you assume that individuals who act badly in the private sphere will suddenly become virtuous when they are part of the government.The second level of error, once you get this far, is to require that the market action achieve a better outcome without including all the continuing, institutional costs of state action in the accounting. So, for example, other parts of the continuing costs of accepting state action to solve this individual toxic-exposure problem in the Deep Horizon aftermath is that Americans will be robbed every April 15th of five in twelve parts of their income (on average), and be randomly killed in no-knock drug raids. And it’s no use protesting that these abuses are separable from the “good” parts of government as long as you’re also insisting that the prospect of market failures is not separable from the good behavior of markets! [...]

Rational anarchists like myself know that stateless systems will have tragic failures too, but believe after analysis that they would have fewer and smaller ones.

If this seems doubtful to you, do not forget to include all the great genocides of the 20th century in the cost of statism.

Tea Party Organization Phenomenon

Sunday, August 29, 2010

Making it more difficult than it needs to be

If the european statists realize that at some point the state starts to crowd out the private sector in a destructive manner, shouldn't we?Jobs: Obamanomics has done more than just keep unemployment high during a modest recovery. It may also be keeping high joblessness permanent by raising the costs to businesses of hiring new workers.

July's 9.5% unemployment level was bad enough. But the real problem is that the private-sector jobs machine, which is usually going full tilt at this point in a recovery, now seems to be broken.

To many, it's becoming clear that if President Obama's radical job-killing agenda stays in place, job growth will be nonexistent.

One of America's great advantages has always been its flexible, private-sector labor markets. From 1985 to 2008, U.S. unemployment averaged 5.6%. For the six largest economies in the European Union, the average rate was 34% higher, at about 7.5%.

Yet many of those countries now have jobless rates lower than ours. Why? They've been dropping Keynesian stimulus as a strategy and moving more toward cutting spending and, in some cases, cutting taxes.

Businesses today face rising burdens — from ObamaCare, the financial overhaul, the expiration of tax cuts for entrepreneurs, the threat of new energy taxes or the surge in growth strangling regulations on business — that discourage hiring.

"The real threat to a robust recovery on the labor side," Gary Becker, a Nobel Prize-winning economist, warned recently, "has come from employer and entrepreneurial fears that once the economic environment improves, a Democratic Congress and administration will pass pro-union and other pro-worker legislation that will raise the cost of doing business and cut profits."

It's never been costlier to hire and keep a worker employed. And as ObamaCare kicks in and Bush's tax cuts expire — not to mention the huge tax hikes that will be needed to make Social Security and Medicare solvent — businesses will simply quit hiring.

This Keynes-on-steroids model has been tried before, in Europe. It didn't work. It led to permanently high levels of joblessness — what economists call structural unemployment.

A recent peer-reviewed study in Sweden found that for every 100 new jobs government creates, 114 are destroyed in the private sector. Similarly, a French study of data from OECD countries from 1960 to 2000 discovered, on average, "creation of 100 public jobs may have eliminated about 150 private sector jobs."

In short, it was a disaster that the U.S. is now duplicating. The next Congress should have no greater priority than reversing it all.

The very nature of an economy

In the United States, the economic mystery of 2010 is the persistence of high unemployment, in spite of the application of the stimulus treatment that follows the prescription of the prevailing Keynesian orthodoxy. I wish to offer an alternative to that orthodoxy.

For the followers of John Maynard Keynes, economic activity consists of spending. When economic activity slows down, their prescription is to increase spending by government, businesses, consumers, or all three. Instead, what I like to say is that “economic activity consists of sustainable patterns of specialization and trade.” This is my mantra of macroeconomics.Here is a simple pattern of specialization and trade: Suppose that all of us eat grain and fruit, which we could grow for ourselves. If some of us have land better for fruit trees, while others have land better for growing grain, then specialization and trading can pay off. It is inefficient to waste good tree land by growing grain on it and to waste good grain land by planting trees on it. Instead, economic activity gives all of us more to eat.

What I mean by a sustainable pattern of specialization and trade is that everyone involved would voluntarily continue to follow the pattern. In accounting terms, profits are a sign of sustainability. If the accounts show a profit, then the value of output exceeds the cost of input. If not, then the pattern is not sustainable.

As conditions change, the patterns of specialization and trade evolve. For example, improvements in transportation make new trade patterns sustainable. Recall the changes brought about by ocean-crossing sailing ships, then steamboats, then railroads, then the automobile and the airplane. As new patterns become sustainable, older patterns become unprofitable and therefore unsustainable. The truck replaced the horse-drawn cart.

Patterns of specialization and trade have become more complex over time. The example of fruit pickers and grain harvesters could have been used hundreds of years ago. But many of the jobs that form today's pattern of specialization and trade are less than 50 years old—or younger.

The contemporary pattern of specialization and trade can be described as roundabout production. I first heard the term in a course on capital theory that Alan and I took from Paul Samuelson. Samuelson was explaining the Austrian theory of capital, as articulated by Eugen von Böhm-Bawerk, who developed his analysis more than a century ago.

The idea of roundabout production is to use intermediate activities to increase final output.

The trend is for the proportion of people employed in final-stage production to get smaller and smaller. Two or three generations ago in the United States, agricultural workers and manufacturing production workers made up half of the labor force. Today, that figure is less than 10 percent. However, thanks to roundabout production, we can produce more manufactured goods and more food than ever.Much of today's American workforce is engaged in roundabout production, which Böhm-Bawerk equated with capital. There is no longer a meaningful distinction between labor and capital. Labor is capital.

If labor is capital, then we have lost the automatic tight connection between spending and employment. Firms can vary their output with little or no variation in employment. This explains how we can have a “jobless recovery,” meaning a large percentage increase in output without a comparable percentage increase in employment. For firms in today's economy, labor represents an investment. Firms hire workers in order to develop capabilities that will eventually produce output more efficiently. The return on an investment in workers may take as long or longer to realize as the return on investment in a machine. The return on investing in workers may be at least as uncertain as the return on investing in equipment.

The phenomenon of roundabout production suggests a story for the current recession. The economy was suddenly caught in an unsustainable pattern of production, which involved too much housing construction in the “sand states” of Florida, Nevada, and California as well as too much financial activity related to mortgages and mortgage securities.

The suddenly unsustainable housing and mortgage boom comes atop the ongoing obsolescence of various patterns of specialization, as the Internet and globalization continue to foster new forms of organization and competition. The result of the boom-bust cycle superimposed on the ongoing obsolescence is to overload the market's ability to reconfigure production patterns so that workers are fully employed.

The market needs to undertake a recalculation in order to deploy workers in a new, sustainable pattern of specialization and trade. The process involves gradual, decentralized trial and error. Firms need to be launched by entrepreneurs, who will make risky investments in employees. The failure rate will be high, but eventually the successes will have a cumulative effect that brings about more economic activity.

The challenge is made difficult by the increasing specialization of labor-capital. The problem of matching skills with needs in roundabout production is much more complex than the problem of adding or subtracting workers in final-stage production.

The Keynesian prescription for a recession is to increase government spending. Even if the resulting output is not valuable (the proverbial digging ditches and filling them in again), the thinking is that this will stimulate productive output. Again, this is based on the theory that economic activity is spending. Supposedly, spending will encourage more spending, through the “multiplier” effect.

From our more Austrian perspective, the Keynesian prescription will fail. Government spending tends to create or reinforce unsustainable patterns of production—temporary housing booms, transitory increases in auto sales, and the like. However, there is no reason to expect unsustainable patterns of production to stimulate the creation of sustainable patterns of specialization and trade. If anything, it would seem likely that government support for unsustainable patterns of production could make the market's recalculation problem more confusing. It will delay long-term recovery, rather than hasten it.

What needs to emerge are new, sustainable patterns of specialization and trade. Government does not have much incentive to create sustainable patterns of specialization and trade. In fact, the political system tends to favor subsidies to outmoded and unsustainable businesses.

Government could reduce the cost of investing in labor-capital. If it can be done in a fiscally responsible way, it would help to reduce the marginal tax rates on investment (the corporate profits tax) and employment (the payroll tax). This may require offsetting tax changes, such as eliminating the mortgage interest deduction or the deductibility of employer-provided health insurance.

On the whole, the best way to help the process of market recalculation and the creation of sustainable patterns of specialization and trade may be for government to get out of the way.

Well there are some things that might help but policy makers have chosen not to do them. Many of the things that have been done are counterproductive.

Saturday, August 21, 2010

It's not pretty to watch

To be blunt, Obama suffers from a lifetime of others excessively praising his intellect. It insulates him from ideas and facts that conflict with his pre-existing liberal rubric (so “every economist” believed his stimulus would work). It leaves him unprepared to engage in real debate with informed opponents (e.g. the health-care summit). It skews his understanding of how geopolitics works, as he imagines that his own wonderfulness can sway adversaries and override nations’ fundamental interests (the Middle East).(ht/instapundit)

It’s a deadly combination — intellectual arrogance and lack of sympatico with the public — that leads him again and again to stumble. And when his shortcomings lead to embarrassment or failure, he strikes out in frustration — at Israel, at the media, and at the American people. The image of himself clashes with the results he achieves and the reaction he inspires. No wonder he’s so prickly. You’d be, too, if everyone your entire life had told you that you were swell but now, when the chips are down and the spotlight is on, you are failing so badly in your job.

Friday, August 20, 2010

We the People vs. The Elites, yet again

At the time when it was written, however, the Constitution was a radical departure from the autocratic governments of the 18th century. Since it was something so new and different, the reasons for the Constitution’s provisions were spelled out in the Federalist, a collection of essays written by three of the writers of the Constitution, as a sort of instruction guide to a new product.

The Constitution was not only a challenge to the despotic governments of its time, but has been a continuing challenge — to this day — to all those who think that ordinary people should be ruled by their betters, whether an elite of blood, or of books, or of whatever else gives people a puffed-up sense of importance.

It is no coincidence that those who imagine themselves so much wiser and nobler than the rest of us should be at the forefront of those who seek to erode constitutional restrictions on the arbitrary powers of government. How can our betters impose their superior wisdom and virtue on us, when the Constitution gets in the way at every turn, with all its provisions to safeguard a system based on a self-governing people?

To get their way, the elites must erode or dismantle the Constitution, bit by bit, in one way or another. What that means is that they must dismantle America. This has been going on piecemeal over the years, but now we have an administration in Washington that circumvents the Constitution wholesale, with its laws passed so fast that the public cannot know what is in them, its appointment of “czars” wielding greater power than Cabinet members’, without having to be exposed to public scrutiny by going through the confirmation process prescribed by the Constitution for Cabinet members.

Those ideas are captured rather well in this video:

Wednesday, June 09, 2010

News You Can Mews

The parasite, Toxoplasma gondii, has been transmitted indirectly from cats to roughly half the people on the planet, and it has been shown to affect human personalities in different ways.

Research has shown that women who are infected with the parasite tend to be warm, outgoing and attentive to others, while infected men tend to be less intelligent and probably a bit boring. But both men and women who are infected are more prone to feeling guilty and insecure. [...]

Can a common cat parasite account for part -- even if only a very small part -- of the cultural differences seen around the world? [...]

Toxoplasma, he notes, is "frighteningly amazing."

It can change the personality of a rat so much that the rat surrenders itself to a cat, just as the parasite wanted.

The parasite's eggs are shed in a cat's feces. A rat comes along, eats the feces, and becomes infected. The behavior of the rat undergoes a dramatic change, making the rat more adventuresome and more likely to hang out around cats.

The cat eats the rat, and the parasite completes its life cycle.

So the next time you think it's a good idea to appease murderous islamo-fascists or turn over complete control of our lives to the government, perhaps you should see if you're infected by this parasite.

Hat Tip: Tim Blair

That Was Lucky

Maybe. In which case, as James Taranto points out, it's good to have fronds in high places.Authorities and witnesses say that a palm tree likely saved the life of Joey Williams, a 4-year-old boy who fell Friday morning from a 17th-floor balcony after chasing a balloon through his apartment home at the Doubletree Grand Hotel Biscayne Bay.

The boy opened a sliding glass door, climbed over a covered balcony railing, bounced off the crown of the palm tree and safely landed on the ``dirt surface'' of an area surrounding the hotel's 10th-floor pool, said Kenia Reyes, a Miami police spokeswoman.

``It's a miracle -- he doesn't appear to have broken a bone,...''

I just love it when real news sets up for full groan humor!

Tuesday, May 25, 2010

How Lobbying Works

The executives of a corporation hire a lobbyist. The lobbyist figures out which Senators and Representatives can write and/or get legislation passed. The executives (and underlings) donate money to those Senators and Representatives and even the President in order to further that process. Because these donations are public information, the lobbyist is able to compile a list of donations from the employees of that corporation and calculate a total. The lobbyist goes to the politicians and points out the "generosity" of the corporation. The politicians push legislation through that benefits the corporation.

The politicians, the lobbyists, and the corporations win. The taxpayers lose.

There are some interesting subtleties. The corporation does not demand or require that anybody donate to various campaigns. That would be illegal. Indeed, they may not even suggest it directly. Instead, it's known through the grapevine (but certainly not officially) that your campaign contributions will be monitored (and can be because it's all public information).

When describing corporation strategy and business development in meetings and in company newsletters, the politicians that can help the company are identified. You then donate to those campaigns. You get raises and bonuses that are partly based on reimbursing you for those political donations. Again, not officially, but that's how it works. You don't have to do it, but it will adversely affect your compensation and career if you don't.

It's funny to me that most people think that making donation information public makes politics somehow more fair when, in fact, the whole purpose of doing it this way was to enable corporations to direct their executives and employees to support various candidates. If campaign contributions were secret, it would be much harder to do.

That's why a Media Matters "correction" (via an Instapundit post and Reason article) is so silly. The "correction" was that various articles in the main stream and non-main stream media were incorrect when they stated that Obama received a huge amount of money from BP. According to Media Matters, the money didn't come from BP, but rather from employees of BP.

It's pretty much the exact same thing!

Monday, May 24, 2010

The Warming Phoenix Rises From the Ashes

That's why Climategate was so damaging to the warmenist cause. The credibility and therefore the authority of the main IPCC scientists was called into question. Without that credibility, the warmenists main argument was damaged and public support for doing something disintegrated.

The National Research Council was funded by Congress to study climate change and has now produced 3 reports totalling over 800 pages. I've scanned the first 100 pages and it looks to be nearly a complete regurgitation of the IPCC's last report (AR4), except that at the end of many sections the primary conclusion was that new bureaucracies and scientific organizations should be created to continue studying climate change.

How clever! Since the IPCC's credibility was damaged, why not take more or less the same material and have some scientists with reputation intact spout the same old alarmist stuff. Now the warmenists can appeal to authority again and march forward to world domination or whatever their goal is.

The credibility of the IPCC is dead - long live the credibility of the National Research Council!

Thursday, May 20, 2010

Saturday, May 01, 2010

The Future of Recorded Music

The reason I decided not to even try to make money is that the success of a band (or artist) and its music is only partly dependent on the music. More important is the marketing: the shows the band does (choreography, pyrotechnics, stunts, and other entertaining moments), the persistence of the band staying in the public's consciousness, the news and buzz about the band (personalities, arrests, drug use, etc.), and so forth. Sure, the music of some popular bands is pretty good, but some popular bands have pretty marginal musicians with pretty marginal songs. In any case, the music of popular bands is no better in any objective sense than the music of many unknown bands.

Relatively recently, I stumbled upon an interesting blog called Cerebellum Blues. Jeff Shattuck, the blogger, suffered a brain injury and woke up with a "rekindled" desire to write songs. He's now recorded his first album and is wrestling with how to make money from his efforts. He's spending a lot longer than 25 seconds thinking about it though. That got me thinking about it again as well.

Unfortunately, I've come to the same conclusion: even though his songs are, in my opinion, quite good, he's going to have a tough, tough time of it. Especially since he can't really do the concert thing due to persistent dizziness due to his brain injury.

The standard business model assumes that the demand side of the equation is the people who want to listen to music and the supply side of the equation is those involved in producing the music to satisfy demand.

However, in the case of music, demand and supply are also inverted in some sense. Humans are driven to create, and creating music is particularly fun and satisfying (at least for people like me). It's even more satisfying when people actually listen to your music. For example, I can't imagine that even a single musician or song writer would say something even vaguely like, "I couldn't care less if people listen to my music as long as I make money at it." Everybody wants to write and play for other people. That's a fundamental need.

In the case of that need, the demand is for people to listen to your music. The supply is then those people who are willing to listen to that music. In other words, regarding satisfying the need of the musician or song-writer to have others listen to his or her music, that musician should be paying the listeners, not the other way around.

However, first let's consider supply and demand from the more traditional perspective. Even from this perspective it's tough and getting tougher to make money solely based on recorded music.

Supply

Let's say approx 1 in 10,000 people has wherewithal and motivation to write and record songs with no expectation of generating any income from the recording those songs. Why might these people do that?

1.) Musicians create "demos" to get gigs at various venues (vast majority).I'm guessing that there are on the order 100,000 such people in the United States alone, and soon there will be 1,000,000 such people worldwide. Let's say each writes 10 songs a year. That's 10,000,000 new songs per year. However, songs are forever (for example, I noticed that my 13 year old daughter has a 40 year old album by the Beatles on her iPod). So there will be around 1 billion new songs created per century.

2.) Serious hobbyist (me for example, also silicon-valley entrepreneurs after IPO).

Cost of Supply

Each song can be replicated for tiny fractions of a penny. With today's equipment, it takes maybe 40 man-hours per song to record and engineer (mix) and the efforts will likely result in a pretty high quality recording. The recording equipment is an iMac (or other computer) with a few hundred dollars of software (or even free if you don't mind some limited functionality and an occasional crash) and a few microphones (for vocals and to mike the instruments, amps and drums). The musicians have instruments which may be quite expensive, but they probably don't need anything special for recording.

So there's very little cost and very little effort involved in recording songs. Other than the musicians' and song writer's effort, the total cost can be almost nothing.

Demand

My guess is that an average person is interested in listening to maybe 10,000 different songs in a lifetime. My personal observation is that about half the people can't even really tell if a recording is in tune or not and another 40% can tell but don't really care very much. As a result 90% of people are happy enough with fairly low quality recordings and certainly today's computer based recording equipment is plenty good for that. Therefore, the vast majority of songs being recorded are good enough for 90% of the population.

With 1 billion songs per century and the need for a total of 10,000 songs, that's an oversupply of 100,000 to one! Even dividing by some large number of genres and even if I'm off by orders of magnitude, that's quite an oversupply for 90% of the population.

Connecting Supply to Demand

One argument against free music in the past is that there may be millions of songs, but how does one find songs that they like? Certainly some intermediary like a recording exec needs to do some filtering, right?

Well, no. One problem is that the recording execs can't get through the millions of songs either, so that route guarantees inferior music being distributed.

Technology to the rescue! With the Internet radios (Pandora, Jango, last.fm, etc.) people rate songs so you'll be automagically fed songs you like!

More on Supply/Demand Inversion

It's actually already nearly gotten to the point where Supply versus Demand has inverted, where the supply is ears to listen and demand is songwriters who want to have their music heard. Jango has a service call Jango Airplay where song writers can pay to have their music heard. It's $30 for 1,000 plays (i.e. a thousand individuals will be fed your song when listening to Jango). Pretty cool really. And the 90% of the population that's not to picky will have no reason to ever pay for recorded music again. Who knows? Eventually they may even get paid to listen to songs.

Back to Jeff. The best chance he has, in my opinion, is that he has a unique and interesting story (at least to me): "Suffered a serious injury and woke up with a rekindled desire to write songs." Seems like that could get him some human interest stories in major media which might bring people to his site and sell his CDs.

However, from what I can tell, he seems determined to "make it" based on the quality of his songs. Though his songs are good, I wish him luck because I think he'll need it.

Wednesday, April 28, 2010

Great Recession(4): wholesale banking panic

This financial crisis has had two legs: the initial boom and bust in housing prices, primarily in the USA, and the accelerator mechanism that then turned this crisis into a panic, affecting financial institutions almost indiscriminately, and countries furthest away from the USA were among the worst performers.There is much more there or excerpts of his paper linked to herein:

All bond prices plummeted (spreads rose) during the financial crisis, not just the prices of subprime‐related bonds. These price declines were due to a banking panic in which institutional investors and firms refused to renew sale and repurchase agreements (repo) – short‐term, collateralized, agreements

that the Fed rightly used to count as money. Collateral for repo was, to a large extent, securitized bonds. Firms were forced to sell assets as a result of the banking panic, reducing bond prices and creating losses. There is nothing mysterious or irrational about the panic. There were genuine fears about the locations of subprime risk concentrations among counterparties. This banking system (the “shadow” or “parallel” banking system) ‐‐ repo based on securitization ‐‐ is a genuine banking system, as large as the traditional, regulated and banking system. It is of critical importance to the economy because it is the funding basis for the traditional banking system. Without it, traditional banks will not lend and credit, which is essential for job creation, will not be created.

U.S. financial history is replete with banking crises and the predictable political responses. Most people are unaware of this history, which we are repeating. A basic point of this note is that there is a fundamental, structural, feature of banking, which if not guarded against leads to such crises. Banks create money, which allows the holder to withdraw cash on demand. The problem is not that we have banking; we need banks and banking. And we need this type of bank product. But, as the world grows and changes, this money feature of banking reappears in different forms. The current crisis, far from being unique, is another manifestation of this problem. The problem then is structural.

There was a banking panic, starting August 9, 2007.

The fundamental business of banking creates a vulnerability to panic because the banks’ trading securities are short term and need not be renewed; depositors can withdraw their money. But, panic can be prevented with intelligent policies. What happened in August 2007 involved a different form of bank liability, one unfamiliar to regulators. Regulators and academics were not aware of the size or vulnerability of the new bank liabilities.

In fact, the bank liabilities that we will focus on are actually very old, but have not been quantitatively important historically. The liabilities of interest are sale and repurchase agreements, called the “repo” market. Before the crisis trillions of dollars were traded in the repo market. The market was a very liquid market like another very liquid market, the one where goods are exchanged for checks (demand deposits). Repo and checks are both forms of money. (This is not a controversial statement.) There have always been difficulties creating private money (like demand deposits) and this time around was no different.

The panic in 2007 was not observed by anyone other than those trading or otherwise involved in the capital markets because the repo market does not involve regular people, but firms and institutional investors. So, the panic in 2007 was not like the previous panics in American history (like the Panic of 1907, shown below, or that of 1837, 1857, 1873 and so on) in that it was not a mass run on banks by individual depositors, but instead was a run by firms and institutional investors on financial firms. The fact that the run was not observed by regulators, politicians, the media, or ordinary Americans has made the events particularly hard to understand. It has opened the door to spurious, superficial, and politically expedient “explanations” and demagoguery.

As explained, the Panic of 2007 was not centered on demand deposits, but on the repo market which is not insured. As the economy transforms with growth, banking also changes. But, at a deep level the basic form of the bank liability has the same structure, whether it is private bank notes (issued before the Civil War), demand deposits, or sale and repurchase agreements. Bank liabilities are designed to be safe; they are short term, redeemable, and backed by collateral. But, they have always been vulnerable to mass withdrawals, a panic. This time the panic was in the sale and repurchase market (“repo market”).

...banking panics continued. They continued because demand deposits were vulnerable to panics. Economists and regulators did not figure this out for decades. In fact, when panics due to demand deposits were ended it was not due to the insight of economists, politicians, or regulators. Deposit insurance was not proposed by President Roosevelt; in fact, he opposed it. Bankers opposed it. Economists decried the “moral hazards” that would result from such a policy. Deposit insurance was a populist demand. People wanted the dominant medium of exchange protected. It is not an exaggeration to say that the quiet period in banking from 1934 to 2007, due to deposit insurance, was basically an accident of history.

The fragility of our unit banks prior to deposit insurance made an interesting contrast to the system of Canadian branch banks which were more stable due to greater diversification and generally more restrained lending practices.

The outstanding amount of subprime bonds was not large enough to cause a systemic financial crisis by itself. ... The issue is why all bond prices plummeted. What caused that? ... Outstanding subprime securitization was not large enough by itself to have caused the losses that were experienced. Further, the timing is wrong. Subprime mortgages started to deteriorate in January 2007, eight months before the panic in August.

He is talking here about the early stages of panic before it became full blown in the Fall of 2008.

... Subprime started significantly deteriorating well before the panic... Subprime will play an important role in the story later. But by itself it does not explain the crisis.

Holding loans on the balance sheets of banks is not profitable. This is a fundamental point. This is why the parallel or shadow banking system developed. If an industry is not profitable, the owners exit the industry by not investing; they invest elsewhere. Regulators can make banks do things, like hold more capital, but they cannot prevent exit if banking is not profitable. “Exit” means that the regulated banking sector shrinks, as bank equity holders refuse to invest more equity. Bank regulation determines the size of the regulated banking sector, and that is all. One form of exit is for banks to not hold loans but to sell the loans; securitization is the selling of portfolios of loans. Selling loans – while news to some people—has been going on now for about 30 years without problems.

... No one has produced evidence of any problems with securitization generally; though there are have been many such assertions. The motivation for banks to sell loans is profitability.

The parallel or shadow banking system is essentially how the traditional, regulated, banking system is funded. The two banking systems are intimately connected. This is very important to recognize. It means that without the securitization markets the traditional banking system is not going

to function.

Institutional investors and nonfinancial firms have demands for checking accounts just like you and I do. But, for them there is no safe banking account because deposit insurance is limited. So, where does an institutional investor go to deposit money? ... The answer is that the institutional investor goes to the repo market.

A problem with the new banking system is that it depends on collateral to guarantee the safety of the deposits. But, there are many demands for such collateral. ... The demand for collateral has been largely met by securitization, a 30‐year old innovation that allows for efficient financing of loans. Repo is to a significant degree based on securitized bonds as collateral, a combination called “securitized banking.” The shortage of collateral for repo, derivatives, and clearing/settlement is reminiscent of the shortages of money in early America, which is what led to demand deposit banking.

...There’s another aspect to repo that is important: haircuts. ... Prior to the panic, haircuts on all assets were zero! For now, keep in mind that an increase in the haircuts is a withdrawal from the bank. Massive withdrawals are a banking panic. That’s what happened. Like during the pre‐Federal Reserve panics, there was a shock that by itself was not large, house prices fell. But, the distribution of the risks (where the subprime bonds were, in which firms, and how much) was not known. Here is where subprime plays its role. Elsewhere, I have likened subprime to e‐coli (see Gorton (2009a, 2010)). Millions of pounds of beef might be recalled because the location of a small amount of e‐coli is not known for sure. If the government did not know which ground beef possibly contained the e‐coli, there would be a panic: people would stop eating ground beef. If we all stop eating hamburgers for a month, or a year, it would be a big problem for McDonald’s, Burger King, Wendy’s and so on. They would go bankrupt. That’s what happened.

Faced with the task of raising money to meet the withdrawals, firms had to sell assets.

The development of the parallel banking system did not happen overnight. It has been developing for three decades, and especially grew in the 1990s. But bank regulators and academics were not aware of these developments. Regulators did not measure or understand this development. As we have seen, the government does not measure the relevant markets. Academics were not aware of these markets; they did not study these markets. The incentives of regulators and academics did not lead them to look hard and ask questions.

There are some interesting summary points there in conclusion. Also a book based upon the authors earlier papers is mentioned here.

Eric Falkenstein offers a comparison: Gorton vs Lewis

His main evidence that this was a system-wide crisis was that securities backed by autos, credit cards, student loans, and financial companies of varied focus all declined, even though default rates in these other classes were not changing much. A financial crisis is when all finance becomes suspect, created a self-fulling prophesy because the system is always insolvent if there is no confidence in the system.

It's very interesting to think of financial crises, and recessions they cause, this way, as overreactions caused by people not being able to suss out the essence of a crisis in real time. Gorton notes crises occurred regularly in the US (1819, 1837, 1860, 73, 84, 90, 93, 1907, 1914, 1931-33), and every time, people are befuddled. When a a drastic change occurs, such as the change from Free Banking era (1837-62) to the National Banking era, or the creation of the Federal Reserve, after about 10 years they think they have eliminated business cycles. They put in new institutions, but because they don't fully understand the old institution, they fail in totally unappreciated new ways.

Gorton notes that fixes are perhaps futile. Indeed, he has some recommendations, one that the government insure 'approved AAA' paper, to help reduce the risk of a panic, but given their role in the reduction of credit underwriting standards (documented on page 66), it is then likely they would have made the essential mistake worse, because one thing government does not do well is admit mistakes, because they don't have to (unfortunately, no government agency has gone bankrupt).

I would suggest that the US financial system was also insolvent in 1975,1981,1990, and that if you had to mark their books to market, (indeed we had new accounting, FAS 157 that tried to apply market prices to accounting during the crisis), this would basically cause massive dislocations. Why not increase bank capital rates from 4-8%, to 20+%? I don't see a consistent risk premium in financial markets, so the cost is rather low. That is, the market does not require a 6% return premium to bank equity, so one does not need that kind of leveraged return.

Alas, most people will find Gorton a bit too dry, too many references, too much math (there are a handful of algebraic equations). Michael Lewis, in contrast, takes the Gladwellian approach to big problems, which is always well received. Indeed, I have seen him an on TV with several different interviewers discussing his latest book, The Big Short [I expect Russ Roberts at econtalk to interview him and totally agree, notwithstanding the 5 other authors with orthogonal diagnoses he also totally agreed with]. Lewis is considered an expert because he worked on Wall street for 2 years and wrote Liar's Poker, an insider's view of the bluster of rich young men. As anyone who has worked in an industry for a couple decades knows, after only 2 years in the business, the impressions of a kid right out of college, no matter how smart and eloquent the sojourner, are invariably quite naive. ... Ultimately Lewis blames everyone, but especially greedy bankers, and so in a banal sense he is correct.

But Lewis will most assuredly sell more books than Gorton, part of the reason these crises are endogenous.

Stephen Spruiell & Kevin Williamson offer some ideas on shadow banking reform:

The really offensive thing about the bailouts was the prevailing sense of adhocracy — that Congress and the White House and the Treasury and the Fed were more or less making things up as they went along. This bank got rescued, that one didn’t. This firm got a bailout on generous terms, that one got the pillory.

Before we can get our economy fully un-TARPed, un-Fannied, and un-Freddied, we need an FDIC-style resolution authority that can do for the shadow banking system what the FDIC does for banks: police safety and soundness and, when necessary, take troubled institutions into custody and disassemble them in an orderly manner.

The institutions that make up the shadow banking system are a diverse and complicated lot: If traditional banking is a game of checkers, this is 3-D chess on dozens of boards at the same time. It is therefore likely that the regulators will lack the expertise to establish appropriate, timely resolution programs for the complex institutions they are expected to govern. The solution to that problem is found in Columbia finance professor Charles Calomiris’s proposal that every TBTFI — Too Big to Fail Institution — coming under the new agency’s jurisdiction be required to establish and maintain, in advance, its own resolution plan, which would be subject to regulatory approval.

Such a plan — basically, a pre-packaged bankruptcy — would make public detailed information about the distribution of losses in the event of an institutional failure — in other words, who would take how much of a haircut if the bank or fund were to find itself in dire straits. This would be a substantial improvement on the political favor-jockeying that marked the government’s intervention in General Motors, for instance, or the political limbo that saw Lehman doing nothing to save itself while waiting to be rescued by a Washington bailout that never came. The authority’s main job would be to keep up with the resolution plans and, when necessary, to execute them.

Taking a fresh regulatory approach would give us the opportunity to enact some useful reforms at the same time. At present, capital requirements — the amount of equity and other assets financial firms are required to hold in proportion to their lending — are static: X cents in capital for every $1 in, for example, regular mortgage loans. This makes them “pro-cyclical,” meaning that, during booms, banks suddenly find themselves awash in capital as their share prices and the value of their assets climb, with the effect that they can secure a lot more loans with the assets they already have on the books. But the requirements are pro-cyclical on the downside, too: During recessions, declining share and asset prices erode banks’ capital base, hamstringing their operations and making financial contractions even worse. Instead, we should use counter-cyclical capital requirements: During booms, the amount of capital required to back each dollar in lending should increase on a pre-defined schedule, helping to put the brake on financial bubbles and to tamp down irrational exuberance. During downturns, capital requirements should be loosened on a pre-defined schedule, to facilitate lending and to keep banks from going into capital crises for mere accounting reasons. But these counter-cyclical capital requirements should begin from a higher baseline: The shadow banking system exists, in no small part, to skirt traditional capital requirements, and its scanty capital cushions helped make the recent crisis much worse than it had to be.

As always, the devil is in the details. Furthermore, the prepackaged bankruptcy features must be credible. Any framework that might work will require considerable thought and deliberation.

As with some of the matters highlighted in earlier posts in this series, this is getting very little emphasis in the public arena.

Returning to the contributing factors and events relevant to the panic, Reuven Brenner offers:

Confusing the responsibilities of the private markets and the government leads to misguided policies. Some analysts draw the dangerously wrong conclusion that the crisis of 2008 simply was a failure of capitalism. Judge Richard Posner, for example, recently argued that “the key to understanding is that a capitalist economy, while immensely dynamic and productive, is not inherently stable.” Whether a capitalist economy is stable or not might be a worthwhile topic for abstract speculation. But the events of 2008 shed no light on it, since what they actually tell is the story of what happens when governments neglect their responsibilities.

In a well-functioning market, the chances of all the players making the same mistake in the same direction is negligible. But systemic errors—errors in which a plurality of the players all err in the same direction—can and do occur when governments forget what makes a commercial society tick. This can occur suddenly, as in a communist revolution. Or it can occur imperceptibly over years, as during the past decade in the United States. Such governmental neglect of responsibilities prepared the ground for the present day, the worst American financial crisis since the Great Depression.

The financial technology of the past decade created trillions of dollars’ worth of structured bonds—in effect, attempting to do a magic trick by turning the inherently uncertain cash flows of junk bonds into the predictable cash flows of high-grade debt. Subprime mortgages, for example, are a kind of junk bond. Households with insufficient incomes, and often without prospects of securing good ones in the future, were not just granted entry into the market but were also helped (actively, though indirectly, by the mortgage agencies Fannie Mae and Freddie Mac) to speculate in housing on an unprecedented scale.

Home-mortgage debt relative to disposable personal income stood stable around 80 percent between 1957 and 2000 but jumped to 140 percent by 2007. The availability of adjustable-rate mortgages at very low interest rates prevailing in the early part of the decade allowed households to carry these much higher debt levels for a while. However, once the Federal Reserve raised the federal-funds rate from 0.5 percent in 2002 to 5.25 percent in 2007, households no longer could pay the higher debt burden. Meanwhile, financial institutions resold about 65 percent of the face value of the mortgages in the form of AAA-rated securities. This means that they sold the other 35 percent to investors who would absorb losses before any losses accrued to the AAA-rated securities.

Individuals and firms thought money-market funds to be reliable substitutes for bank deposits: always available and invested heavily in structured securities as well as corporate commercial paper. Once it became clear that supposedly AAA-rated securities were in fact prone to default, money-market funds faced a run by fearful depositors, and the market for corporate commercial paper crashed as well.

The collapse of the structured securities market in July 2007 led to the collapse of Bear Stearns in March 2008, the failure of the government-sponsored mortgage guarantors Fannie Mae and Freddie Mac, and eventually the Lehman Brothers bankruptcy in September 2008, followed by the bailout of the nation’s largest commercial banks and the reincarnation of the remaining investment banks and of GMAC as bank-like institutions, with access to funds from the Federal Reserve. Capital markets, as we knew them, shut down. And asset prices predictably then crashed. Too many mistakes, too much mispriced debt.

When this happened, there was no alternative but for the government and the Federal Reserve to step in and become a financial intermediary. The intervention was needed because the mistakes suddenly exposed the fragility of the financial institutions’ funding mechanism. To restore it, the government had to insure the counterparty risks.

Whatever the reasons, at first the government did not, and it allowed Lehman Brothers to fail. Then the government suddenly did: Correcting this blunder of letting the edifice of counterparty claims collapse led then to the dramatic expansion of the Federal Reserve balance sheet and the Treasury’s bailing out the banks.

In truth, the government had no choice: Depositors had to be convinced that they were secure. Otherwise, the government would have failed in its responsibility of providing the default-free assets that are the foundation of commercial banking. We would have had a massive run on the system, and the vanishing liquidity would have been much worse than what we experienced. By guaranteeing bank deposits as well as a great deal of bank debt, and by purchasing more than a trillion dollars’ worth of securities, the government prevented a collapse of the financial system. That was not a matter of ideology or politics but of necessity.

The spending and managing powers of the government have limits. If the government abuses its financial power to buy political support and does not restore the eroded responsibilities, it will eventually fail in its function of providing default-free assets. Without such assets, a commercial society cannot exist, no matter what the constitution of the country says. The words would lose their meaning, and the traditional institutions would be much weakened, becoming a mere façade.

Anyone longing for days gone by in the world of banking should be aware:

Consider the savings-and-loan (S&L) debacle of the 1980’s. The crisis, which erupted only two decades ago but seems all but forgotten, was almost entirely the result of a failure of government to regulate effectively. And that was by design. Members of Congress put the protection of their political friends ahead of the interests of the financial system as a whole.

After the disaster of the Great Depression, three types of banks still survived—artifacts of the Democratic party’s Jacksonian antipathy to powerful banks. Commercial banks offered depositors both checking and savings accounts, and made mostly commercial loans. Savings banks offered only savings accounts and specialized in commercial real-estate loans. Savings-and-loan associations (“thrifts”) also offered only savings accounts; their loan portfolios were almost entirely in mortgages for single-family homes.

All this amounted, in effect, to a federally mandated cartel, coddling those already in the banking business and allowing very few new entrants. Between 1945 and 1965, the number of S&L’s remained nearly constant at about 8,000, even as their assets grew more than tenfold from almost $9 billion to over $110 billion. This had something to do with the fact that the rate of interest paid on savings accounts was set by federal law at .25 percent higher than that paid by commercial banks, in order to compensate for the inability of savings banks and S&L’s to offer checking accounts. Savings banks and S&L’s were often called “3-6-3” institutions because they paid 3 percent on deposits, charged 6 percent on loans, and management hit the golf course at 3:00 p.m. on the dot.

These small banks were very well connected. As Democratic Senator David Pryor of Arkansas once explained:

You got to remember that each community has a savings-and-loan; some have two; some have four, and each of them has seven or eight board members. They own the Chevy dealership and the shoe store. And when we saw these people, we said, gosh, these are the people who are building the homes for people, these are the people who represent a dream that has worked in this country.They were also, of course, the sorts of people whose support politicians most wanted to have—people who donated campaign money and had significant political influence in their localities.

The banking situation remained stable in the two decades after World War II as the Federal Reserve was able to keep interest rates steady and inflation low. But when Lyndon Johnson tried to fund both guns (the Vietnam war) and butter (the Great Society), the cartel began to break down.

If the government’s first priority had been the integrity of the banking system and the safety of deposits, the weakest banks would have been forced to merge with larger, sounder institutions. Most solvent savings banks and S&L’s would then have been transmuted into commercial banks, which were required to have larger amounts of capital and reserves. And some did transmute themselves on their own. But by 1980 there were still well over 4,500 S&L’s in operation, relics of an earlier time.

Why was the integrity of the banking system not the first priority? Part of the reason lay in the highly fragmented nature of the federal regulatory bureaucracy. A host of agencies—including the Comptroller of the Currency, the Federal Reserve, the FDIC and the FSLIC, state banking authorities, and the Federal Home Loan Bank Board (FHLBB)—oversaw the various forms of banks. Each of these agencies was more dedicated to protecting its own turf than to protecting the banking system as a whole.

Adding to the turmoil was the inflation that took off in the late 1960’s. When the low interest rates that banks were permitted to pay failed to keep pace with inflation, depositors started to look elsewhere for a higher return. Many turned to money-market funds, which were regulated by the Securities and Exchange Commission rather than by the various banking authorities and were not restricted in the rate of interest they could pay. Money began to flow out of savings accounts and into these new funds, in a process known to banking specialists by the sonorous term “disintermediation.”

There is much more banking and financial history in that article. The key point is that prior financial arrangements were abandoned not for ideological reasons but because they were no longer tenable.

Just to reiterate the point:

One last point. Once asset markets like this experience a pricing blackout, conventional attempts to help the economy with any kind of fiscal stimulus are worthless. Visibility, transparency and activity must be restored to those asset markets for the economy to recover. Asset markets are an order of magnitude greater in value compared to annual economic output. So far corporate bond market issuance has recovered nicely. Other areas have shown partial recovery and some very little even with help from available Fed lending facilities. Things are getting better, but there is a long way to go. Of course a war on wealth creation won't help.There is a widespread but erroneous belief that the financial crisis has its origins in deregulation dating all the way back to the late 1970s. Therefore any steps to restore the pre-Reagan regulatory system are to be welcomed. This is really bad financial history.

... in the more controlled capital markets of the 1970s, borrowers generally paid more for their loans because there was less competition. Lousy managements were protected from corporate raiders. Savers earned negative real interest rates because of high inflation. Deregulation—such as lifting restrictions on the interest rates banks could pay and charge—and financial innovation delivered real benefits for the U.S. economy in the 1980s and '90s.

Thursday, April 22, 2010

Great Recession(3): rules and regulations

FMM: Returning to “The Great Recession,” it is interesting that you, essentially, charge the SEC with creating adverse information problems in securities markets.

“In the late 1960s, after some investment scandals, the SEC created a cartel by authorizing only a limited number of these agencies to be officially-designated raters. With that government-created cartel in place, the agencies slowly shifted from serving investors to serving the issuers of bonds.”

Can you elaborate on the nature of the SEC-created cartel and in what ways it is serving the issuers of bonds rather than the investors?

SH: The SEC authorized those agencies to have privileged status in the wake of some financial problems in the late 60s and early 70s. The thinking, I guess, was to more closely oversee the officially approved firms. The SEC then said that banks could only hold fancy securities rated by one of these three agencies. Once that happened, the big shift occurs. Before that, the agencies served the buyers by, like Consumer Reports, giving them information and ratings about the instruments. But once their approval was needed in order for the securities to be marketed, the sellers started going to them to get the ratings they wanted. The raters then had an incentive to provide good ratings so as to not lose the business to their other two co-cartelists. They also then had reason to eliminate the costs of inter-firm competition by coming to more agreement on how to do things. The results, as you can see, were not pretty.

In the absence of free entry into this market, there was no way to correct the mistakes of the cartelists. There was no Hayekian learning process in place.

We read in The Sellout:

At the same time, government-anointed credit raters were assigning triple-A ratings to mortgage-backed securities that in no way deserved them. The Federal Reserve's so-called Basel capital standards gave banks more credit for owning mortgage-backed securities than many other assets, and in 2004 the SEC applied those standards to investment banks, with dramatic results. In 2003, Lehman Brothers held roughly equal amounts of U.S. Treasury bonds and mortgage- and other asset-backed securities. By 2006 the firm's Treasury holdings had barely budged while its mortgage- and asset-backed holdings had almost tripled. Meanwhile, the Fed's easy money policies of the early 2000s subsidized credit and sent the banks looking for higher yields. Mortgage bonds offered high returns and the "safety" of AAA ratings.

As credit spreads began to widen in 2007 and then continued to widen in 2008 it was clear that distress was increasing in the financial system. It wasn't that difficult to understand how investment banks heavily involved in mortgage backed securities were having problems. What didn't make sense was the level of distress I was hearing about at many regular commercial banks. The role of the little known but rather significant recourse rule is explained at some length here: (and in a more limited version here)

There is little evidence that deregulation or banks' compensation practices caused the financial crisis. What did seem to cause it were capital regulations imposed on banks across the world. These regulations explain why bankers who are commonly seen as having recklessly bought risky mortgage-backed bonds in order to boost earnings--and bonuses--actually bought the least-risky, least-lucrative bonds available: those that were guaranteed by Fannie Mae or Freddie Mac or were rated AAA. These securities were decisively favored by capital regulations, raising the question of whether regulation actually increases systemic risk. By definition, regulations aim to homogenize the otherwise heterogeneous behavior of competing enterprises. Since one set of regulations has the force of law, it homogenizes the entire economy in that jurisdiction. But regulators are fallible, and if their ideas turn out to be wrong--as they appear to have been in the case of capital regulations--the entire system is put at risk.

...why did the bursting of the housing bubble cause a financial crisis, that is, a banking crisis?

This might not seem so puzzling at first: commercial banks made many of the mortgage loans that were financed by the Federal Reserve's low interest rates. But the financial crisis was not caused by mortgage defaults directly: it was caused by a sharp drop, in September 2008, in the market price of mortgage-backed bonds, in anticipation of their declining value as the bubble deflated. The first victims of the falling price of mortgage-backed bonds were Fannie and Freddie; in quick succession came the investment bank Lehman Brothers; and finally came the commercial banks--because they held so many mortgage-backed bonds, not mortgages. The question, then, is why the commercial banks held so many mortgage-backed bonds. If deregulation or the quest for high earnings, hence high compensation, did not cause the banks to buy these bonds, what did?

To answer this question, we have to turn in a direction that has been overlooked by the conventional wisdom: an obscure regulation called the recourse rule. The recourse rule was enacted by the Federal Reserve, the Federal Deposit Insurance Corporation, the Comptroller of the Currency, and the Office of Thrift Supervision in 2001.[14] It was an amendment to the international Basel Accords governing banks' capital holdings, and all over the world, these regulations appear to have contributed significantly both to the housing boom and to the financial crisis.

But under the recourse rule, "well-capitalized" American commercial banks were required to spend 80 percent more capital on commercial loans, 80 percent more capital on corporate bonds, and 60 percent more capital on individual mortgages than they had to spend on asset-backed securities, including mortgage-backed bonds, as long as these bonds were rated AA or AAA or were issued by a government-sponsored enterprise (GSE), such as Fannie or Freddie. Specifically, $2 in capital was required for every $100 in mortgage-backed bonds, compared to $5 for the same amount in mortgage loans and $10 for the same amount in commercial loans.

One can readily see that the recourse rule was designed to steer banks' funds into "safe" assets, such as AAA mortgage-backed bonds. The fact that 93 percent of the banks' mortgage-backed securities were either AAA rated or were issued by a GSE shows that this is exactly what the rule accomplished.[16] Unfortunately, these bonds turned out not to be so safe. Without the recourse rule, however, there is no reason for portfolios of American banks to have been so heavily concentrated in mortgage-backed bonds.

The recourse rule did not apply outside the United States, but the first set of Basel accords on bank capital, adopted in 1988,[19] included provisions for even more profitable forms of "capital arbitrage" through off-balance-sheet entities such as structured investment vehicles (SIVs), which were used extensively in Europe. Moreover, in 2006, a second set of bank-capital accords, "Basel II," began to be implemented outside the United States. Basel II took essentially the same approach as the recourse rule, encouraging foreign banks to acquire mortgage-backed securities, just as in the United States.[20]

Here, then, we may have the genesis of the global financial crisis. If so, it turns out to have been caused by the very device--regulation--to which most people now, as they did throughout the twentieth century, look for the "reform" of capitalism. But is it really capitalism when it is so heavily regulated?

In a complex world like ours, nobody really knows what will succeed until it is tried. Competition, which pits entrepreneurs' divergent ideas against each other, is the only way to test these ideas through anything but the highly unreliable process of verbal debate (in which the debaters' competing ideas cannot be simultaneously tested against each other in the real world, instead of in the imaginations of their audience).

Capitalism will probably always be prone to asset bubbles and other manifestations of homogeneous behavior, but only because it is part of human nature for people to go along with the crowd. This is a risk that can be mitigated but not eliminated. But capitalism has a unique feature, competition, that does mitigate it by both encouraging and taking advantage of heterogeneous behavior, that is, innovation.

Homogeneity, on the other hand, is the ineradicable curse of socialism, in which the community as a whole, through its elected (or self-appointed) representatives, decides on the allocation of resources. One plan is imposed on all, as thoroughly as if everyone spontaneously decided to join a herd.[22] And we maintain that homogeneity is also the problem with regulation. Regulations, by their very nature, align the behavior of those being regulated with the ideas of those doing the regulating. Regulations are like mandatory instructions for herd behavior, automatically increasing systemic risk.

The recourse rule, Basel I, and Basel II loaded the dice in favor of the regulators' ideas about prudent banking. These regulations imposed a new profitability gradient over all bankers' risk/return calculations, conferring 80 percent capital relief on banks that bought GSE-issued or highly rated mortgage-backed bonds rather than commercial loans or corporate bonds, and 60 percent relief for banks that traded their individual mortgages for those "safe" mortgage-backed bonds. Only bankers with the most extreme perceptions of the downside, such as JP Morgan's Jamie Dimon, escaped unharmed.

Bank-capital regulations inadvertently made the banking system more vulnerable to the regulators' errors. But this is what all regulations do. Whether by forbidding one activity or encouraging a different one, the whole point of regulation is, after all, to change the behavior of those being regulated. And the direction of change is, obviously, the one the regulators think is wise.

The whole system crashed when the financial regulators' ideas about prudent banking backfired, but such failures are inevitable unless modern societies are so ¬simple that the solutions to social and economic problems will be self-evident to a generalist voter, or even a specialist regulator. That modern societies really are that simple is, in truth, the hidden assumption of modern politics. This is why political conflicts get so ugly: neither side can understand why their adversaries oppose what "self-evidently" should be done, so both sides ascribe evil motives to each other. But the financial crisis has exposed this simplistic view of the world for what it is. In the wake of the crisis, nobody can plausibly deny anymore that modern societies are bafflingly complex. The solutions to social and economic problems are thereby unlikely to be self-evident. The theories that seem so obviously true to voters or regulators may turn out to be disastrously false--unless regulators or citizens are infallible.

That surely would be magical. But there is no more magic to politics than there is to markets. The question raised by the ongoing intellectual contest between socialism and capitalism, and the ongoing practical battle between regulation and competition, is how best to guard against human frailties: By putting all our eggs in one politically decided basket? Or by spreading our bets through the only practical means available: competition?

The complicated interaction of all of the pieces of the puzzle are discussed further in a podcast with Charles Calomiris (notes available but no transcript).

Economist Brian Wesbury informs us of the significant problem of MTM here:

In November 2007, the Financial Accounting Standards Board (FASB) reinstated mark-to-market accounting for the first time since 1938. This rule uses bids (exit prices) to value assets. So far, so good. However, in 2008, the market for asset-backed securities dried up. The prices of bonds that were still paying in full fell by 60 or 70 percent, and these losses often were driven through income statements. This wiped out regulatory capital, caused bankruptcies, and created a vicious downward spiral in the economy.

In retrospect, it is clear that this accounting rule was a potent pro-cyclical force behind the 2008 panic.

Finally, on April 2, 2009, the FASB allowed banks to use “cash flow” to value bonds when the markets are illiquid — the same sentiment that Bernanke expressed before Congress. This fixed the immediate problems in the system, and the economy and financial markets have been on the mend ever since. In fact, the stock market bottom of March 9, 2009, came on the very day news broke that Reps. Barney Frank and Paul Kanjorski would hold a hearing to force the FASB to change the misguided accounting policy.Mark-to-market accounting does not solve problems; it creates them by acting as a pro-cyclical force. Milton Friedman understood this, and he wrote about the devastating link between mark-to-market accounting and the Great Depression bank failures. Franklin Delano Roosevelt finally figured this out in 1938 — he suspended the rule and the Depression ended soon thereafter. Coincidence? We think not.

But as long as bank regulators still impose mark-to-market-style rules — indeed, as long as such rules remain even a threat to the system — the system will not fully heal.

More on the role of mark-to-market accounting in Bob McTeer's post here and Bill Isaac's testimony linked to within is worth a read:

Having trading entities such as proprietary trading desks or hedge funds mark-to-market may be appropriate. Requiring lending institutions which hold assets with a longer term orientation to do so is simply asking for financial instability.I use the term “mark to market accounting,” rather than “fair value accounting.” Everyone’s goal is a fair and descriptive accounting system. There is nothing “fair” about the misleading and destructive accounting regime promoted by the Securities and Exchange Commission and the Financial Accounting Standards Board under the rubric “fair value accounting.” MTM accounting has destroyed well over $500 billion of capital in our financial

system. Because banks are able to lend up to ten times their capital, MTM accounting has also destroyed over $5 trillion of lending capacity, contributing significantly to a severe credit contraction and an economic downturn that has cost millions of jobs and wiped out vast amounts of retirement savings on which millions of people were counting....we believed that MTM accounting would make it very difficult for banks to perform their fundamental function in our economy, which is to convert relatively short-term money from depositors into longer-term loans for businesses and consumers. Banks necessarily have some mismatch in the maturities of their assets and liabilities – it is up to bank management, regulators, and investors to make sure the mismatch is not excessive. Accounting rules made to influence behavior are no substitute for good judgment and can interfere with appropriate business conduct.

...we felt that MTM accounting would be pro-cyclical (which is never a good thing in bank regulation) and would make it very difficult for regulators to manage future banking crises.

The accounting profession, scarred by decades of costly litigation, keeps forcing banks to mark down the assets as fast and far as possible. This is contrary to everything we know about bank regulation. When there are temporary impairments of asset values due to economic and marketplace turmoil, regulators must give institutions an opportunity to survive the temporary impairment. Permanent impairments should be recognized, but assets should not be marked to unrealistic fire-sale prices. Regulators must evaluate the assets on the basis of their true economic value over a reasonable time horizon.

The current world-wide crisis in the financial system demonstrates conclusively that major principles of accounting are much too important to be left solely to accountants.

It is extremely important that bank regulation be counter-cyclical, not pro-cyclical. The time for banks to create reserves for losses is when the sun is shining, not in the middle of a hurricane.

Peter Wallison has some thoughts on deregulation here:

There has been a great deal of deregulation in our economy over the last 30 years, but none of it has been in the financial sector or has had anything to do with the current crisis. Almost all financial legislation, such as the Federal Deposit Insurance Corp. Improvement Act of 1991, adopted after the savings and loan collapse in the late 1980s, significantly tightened the regulation of banks.The repeal of portions of the Glass-Steagall Act in 1999--often cited by people who know nothing about that law--has no relevance whatsoever to the financial crisis, with one major exception: it permitted banks to be affiliated with firms that underwrite securities, and thus allowed Bank of America Corp. to acquire Merrill Lynch & Co. and JPMorgan Chase & Co. to buy Bear Stearns Cos. Both transactions saved the government the costs of a rescue and spared the market substantial additional turmoil.

None of the investment banks that got into financial trouble, specifically Bear Stearns, Merrill Lynch, Lehman Brothers Holdings Inc., Morgan Stanley and Goldman Sachs Group Inc., were affiliated with commercial banks, and none were affected in any way by the repeal of Glass-Steagall.

In a more extensive article here he concludes:

The causes of the financial crisis remain a mystery for many people, but certain causes can apparently be excluded. The repeal of Glass-Steagall by GLBA is certainly one of these, since Glass-Steagall, as applied to banks, remains fully in effect. In addition, the fact that a major CDS player like Lehman Brothers could fail without any serious disturbance of the CDS market, any serious losses to its counterparties, or any serious losses to those firms that had guaranteed Lehman's own obligations, suggests that CDS are far less dangerous to the financial system than they are made out to be. Finally, efforts to blame the huge number of subprime and Alt-A mortgages in our economy on unregulated mortgage brokers must fail when it becomes clear that the dominant role in creating the demand--and supplying the funds--for these deficient loans was the federal government.

If you don't know about the recourse rule, the Basel Accords and mark-to-market accounting rules at a minimum, you can't begin to understand the regulatory failure which gave us the Great Recession.

see also The Myth of Financial Deregulation

Thursday, April 15, 2010

Great Recession(2): government and moral hazard

Even a little bit of restraint on the GSEs would have helped.The current financial crisis definitely resulted from government generated moral risk. The massive federal-government-created and -managed enterprises, Freddie Mac, Fannie Mae and the Federal Home Loan Banks, aka Flubs, (henceforth, collectively the GSEs) are ground zero for the crisis. They were simply too big not to dramatically impact the market. Collectively, the GSEs purchase half of the mortgages issued in the U.S. Collectively, they issued most of the mortgage-backed securities (MBSs) currently in circulation. By design, these institutions created a vast moral hazard that built up over four decades until the system collapsed under the weight of risky behavior.

The GSEs created moral risk in several ways.

(1) By design, the GSEs separated the profit earned from a particular mortgage from the risk of issuing that mortgage. ...

(2) By design, the GSEs hid the hazard of buying their MBSs by using their implied government guarantee. ...

(3) By design, the GSEs had much better credit ratings than did any private actors. ...

I can’t repeat this often enough: By design, the GSEs were intended to distort the markets in favor of more-risky lending and that is exactly what we got. The private institutions that failed did so because they (a) mimicked the business model and practices of the GSEs, (b) bought GSE-issued MBSs, and GSE stock, based on their high ratings and/or (3) issued insurance against the default of the GSEs’ MBSs based on their high ratings.

Here are some thoughts from Steve Horwitz:

FMM: A phrase currently en vogue among politicians attempting to expand government power is “systemic risk.” Does such risk exist? If so, where does it occur and what (if anything) should be done to protect against it?

SH: It exists, but it’s largely created by government! The biggest systemic risk is when government policies cause firms to be tied together in ways that are problematic. The implicit guarantees to Fannie and Freddie created huge systemic risk that markets never would. Same with “too big to fail” in general, as well as Greenspan’s promise that the Fed would clean up the results of any asset bubble. Those policies created risks that run through the whole system.

Charlie Gasparino describes the interaction of public and private players resulting in subsidized risk: (by all means read the whole thing)

Mr. Forstmann knows a thing or two about greedy investment bankers: He's been calling them on the carpet for years, most famously during the 1980s when he fulminated against the excesses of the junk-bond era. He also knows that blaming banking greed alone can't by itself explain the financial tsunami that tore the markets apart last year and left the banking system and the economy in tatters.The greed merchants needed a co-conspirator, Mr. Forstmann argues, and that co-conspirator is and was the United States government.